Deprecated: Creation of dynamic property SocialSharing_Shares_Controller::$models is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/vendor/Rsc/Mvc/Controller.php on line 28

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

The world, and economy, were complex and volatile throughout 2022. In Green Alpha’s signature investing style—combining macro trajectory analysis, identification of problem-fixing companies, fundamental data, and active, benchmark-agnostic portfolio construction—we helped our clients gain market exposure to the Next Economy.

Investing in what’s next (as opposed to what was) means valuing innovation and extrapolating the world economy as it is today into what it is likely to become over the next five to ten years. Within that longer-term context, it can be a challenge to make sense of current events, from geopolitical flare-ups to stock market turmoil. If one’s investing time frame is a year or two, strategies aimed at the growth of the Next Economy may feel volatile. And indeed, most of our strategies underperformed their benchmark index for the year.

Throughout 2022, inflation remained high and interest rates climbed globally. Tied to the looming threat of recession, stocks have been broadly down, and some sectors have been hit harder than others. Many of the sectors in which companies’ share prices dropped the most are within our sphere of interest to invest in and benefit from long-term trends and opportunities.

2022 Macroeconomic Highlights

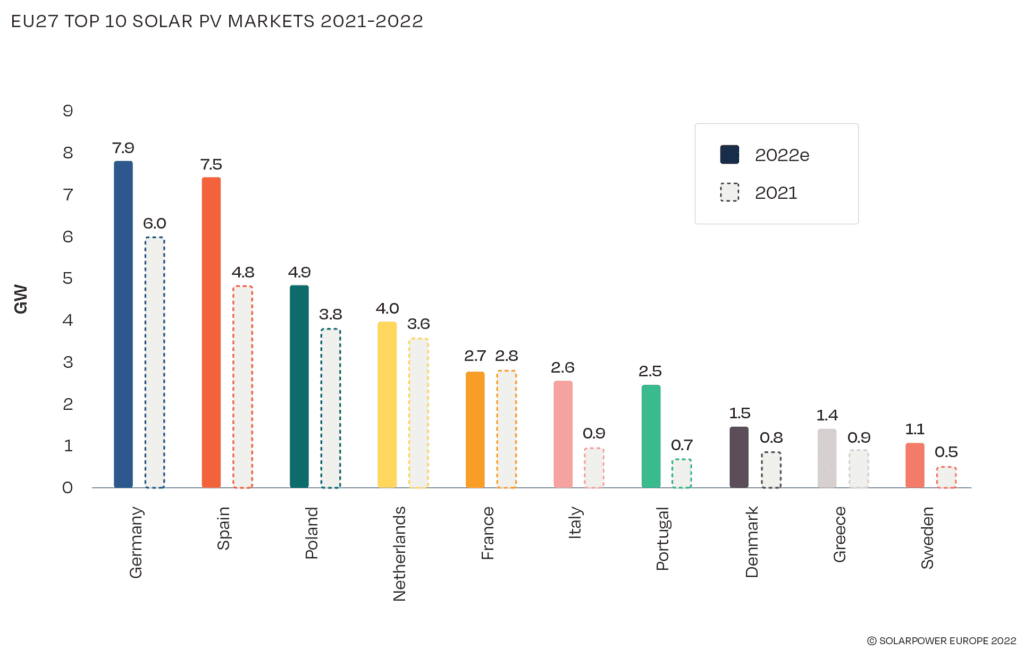

This year proved that people can indeed collectively coordinate to solve real problems. Within Europe, in 2022 alone, natural gas usage was down between 21% and 35%, depending on the country, while solar generation capacity was up 47%. Surely this shows that people and nations can come together to more rapidly decarbonize world energy systems, if properly motivated.

In genomics, 2022 saw dramatic evidence that one-time therapeutics can treat some types of cancer, a vaccine to prevent malaria became available (and is already in use), and universal flu and RSV vaccines were developed. 2023 promises more next-gen vaccines.

In space, the James Webb Telescope and the Double Asteroid Redirection Test (DART) mission were historic advancements in human capabilities and research processes. Artificial intelligence advanced its capabilities dramatically with clear implications for large-scale problem solving and economic productivity acceleration. Quantum computing, as it has the last several years, continued to make progress toward more generalized usefulness and commercial applications. The ultimate synergies that will emerge between AI, machine learning, and quantum computing could make this year’s headlines around Chat GPT and DALL·E 2 seem relatively minor.

So, innovation is accelerating, renewable energies are proliferating, medicine is in unprecedented territory, AI is becoming more powerful, and the groundwork is being laid to set the stage for ever more dramatic and rapid progress.

And yet, these accomplishments are not equaled in the realm of policy. In spite of ambitious agreements signed at 27 COPs, 2022 saw a historic, new record level high of carbon emissions. According to the IPCC, whose language has to be unanimously approved by a very conservative group of 195 nations, “policies currently in place point to a 2.8°C temperature rise by the end of the century. Implementation of the current pledges will only reduce this to a 2.4-2.6°C temperature rise by the end of the century.” If we ask ourselves why the mismatch between political ambition and reality, it comes down to investments. Not enough capital has been directed toward the fixes to the climate crisis, and too much continues to be poured into fossil fuels-oriented sectors and companies.

Green Alpha Investments in 2022

The world today is a constantly, rapidly, and dynamically changing environment; and therefore, Green Alpha is continually evolving our portfolio strategies to ensure best alignment with our thesis. This year, we continued to refine our methodologies and approach to address concepts, such as, but not limited to, more emphasis on social cohesion, equity, and equality, and diversity of leadership. We also worked to improve our understanding of and exposure to food systems, from farms and manufacturing to packaging and grocery store distribution. We continued our focus on identifying leaders in advanced biotech, with the understanding that this is a truly transformative moment in that field, and for the global economy. Property development and management have always posed investment challenges for us; this year we renewed our focus on finding and investing in the REITs that are doing more to solve sustainability challenges than to cause them, while exhibiting excellent fundamentals and returning an above-market dividend. The application of our thesis is refined continually as we hone our objectives and turn those into investment actions.

Green Alpha Investments in 2023 and Beyond

For 2023, Green Alpha is evaluating economic conditions based on first, clear evidence that innovation (in select areas) is increasing both economic productivity and environmental sustainability, and second, with the sober awareness that the world is in many ways still failing to affect energy and sustainability transitions rapidly enough to prevent irreversible, deleterious outcomes. Within those dynamics and our thesis, we look for opportunities to invest for long-term growth and maximum impact.

As an industry, asset management continues to be overwhelmingly backward-looking, investing in industries that have been important historically, but have far less relevance now and in the future. The desire to change and update the status quo is the source of our long-term competitive track records and is also one of the reasons we founded Green Alpha. The general idea that the economy 10 years hence will essentially be the same economy of 10 years ago is a major market inefficiency. The market of the last year-and-a-half or so, sometimes called a “risk-off market environment,” is a manifestation of that inefficiency, wherein things like potential cures for disease and limitless, very cheap energy have been oversold, in deference to fossil fuels and other 19th century technologies.

Green Alpha’s Investment Philosophy in Action

Green Alpha believes that, over time, a company with superior outcomes will see those results reflected in their market returns. Therefore, we refuse to change direction or wander into style drift in the face of downward volatility. On the contrary, we understand that the best time to buy high conviction companies is when they are trading at a discount.

Stocks benefitting from multiple tailwinds, and trading at reasonable prices, will continue to be our focus, even though—and even because—this does not correlate with today’s short-term market orientation. The time horizon mismatch between our investment approach and the markets’ is ultimately okay: we are simultaneously disappointed in a year of underperformance and excited by the opportunity to invest in compelling Next Economy companies at steep discounts, relative to the future results we expect from them.

To our clients and partners who share our vision, please accept our sincere appreciation. See you in 2023.

###

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/