Always invest in the solutions to global systemic risks, never in the causes.

That’s an effective way to preserve and grow long-term capital. That’s investing in the Next Economy.

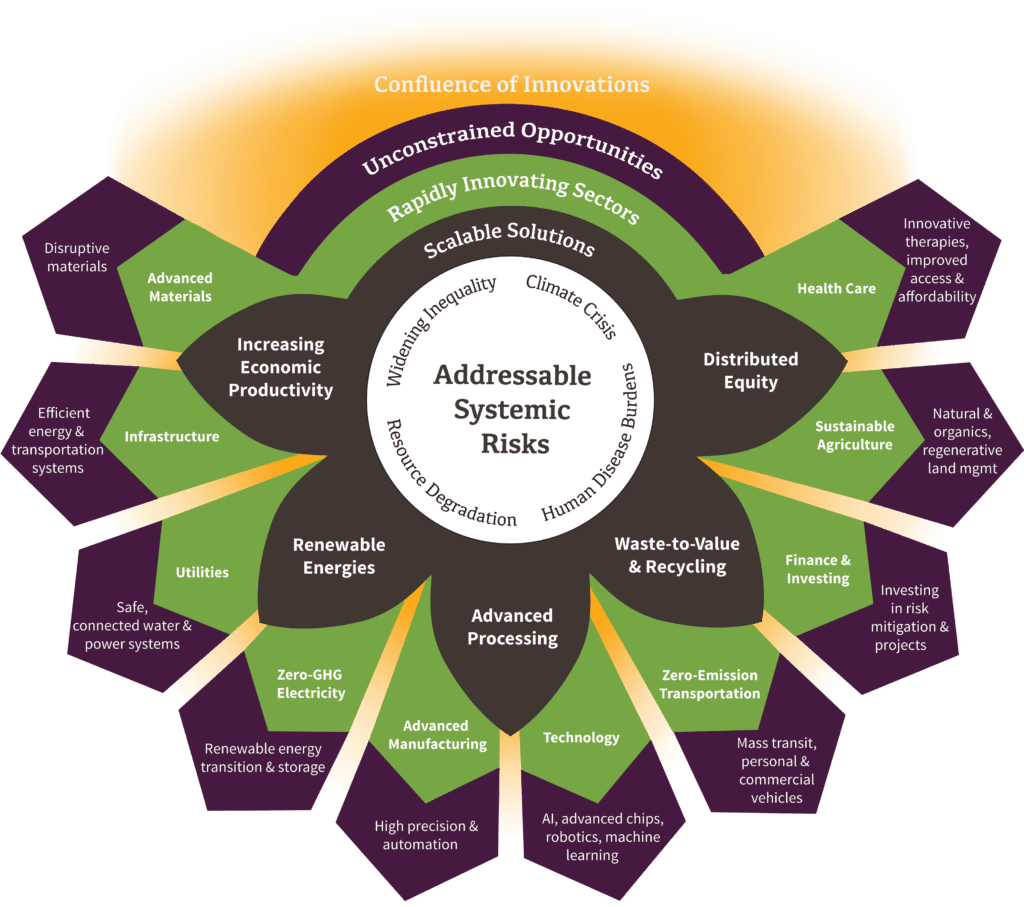

High-functioning, prudently managed, innovative companies that are creating and accelerating solutions to system-level risks like the climate crisis, resource degradation, worsening inequality, and human disease burdens are the greatest change makers and productivity drivers of the twenty-first century. Such firms have a high potential to benefit from dual tailwinds: the ongoing and accelerating transitions to sustainability and net zero operations, as well as product and competitive superiority leading to market share growth.

Green Alpha’s investment philosophy is straightforward: invest in the smartest, most rapidly evolving, economically competitive sustainability solutions; never invest in companies causing global systemic risks.

We developed our investment philosophy and processes in 2007-08 to leverage the best opportunities to both create the strongest and quickest impact on society, and preserve and grow clients’ investment capital over the long term.

ESG Guidelines

When discussing sustainability-oriented investing, it’s conventional to talk about environmental, social, and governance (“ESG”) rating systems and guidelines.

The opportunity to create high-impact, alpha-generating public equity portfolios exists when the research process is intentionally designed to apply impactful ESG criteria in the appropriate order, and solely to companies providing solutions to system-level risks. Unfortunately, many ESG investing processes merely append ESG variables to the end of an existing process. Green Alpha’s Executive Team members each has firsthand experience at prior firms with the limitations of those methods, so they work together to solve for typical ESG deficiencies by evaluating material variables at every step in the investment process, with the most essential variables evaluated first rather than last.

We avoid calling our approach “ESG” and instead trademarked Investing in the Next Economy to describe to our research methodologies, because we believe that many ESG investment systems miss critical variables and do not appropriately prioritize research processes in the optimal order to result in portfolios that create material impact. However, we strive to operate as transparently as possible and know that some investors want insight into the environmental, social, and governance variables we consider to be material.

Sustainable Planet, Sustainable Economy

We begin with big picture, and what we clearly see is that the economy of this century has little to do with those of the past. Green Alpha’s Next Economy Portfolio Theory provides the framework for a solutions-driven investment approach that reduces portfolio risk inherent in the legacy economy, while simultaneously driving capital toward a genuinely sustainable economy.

Rapidly accelerating innovation offers seemingly endless opportunities to mitigate risks falling under the broad buckets of the climate crisis, resource degradation, worsening inequality, and human disease burdens.

All segments of the economy need to become far more effective and efficient in order to fully realize an indefinitely sustainable, thriving economy.

This solutions-oriented, innovation-driven, indefinitely sustainable economy is the Next Economy.

Where there’s dire demand for innovative solutions, there are investment opportunities.

While developing Next Economy Portfolio Theory, we created a roadmap that could lead from the incumbent economy to the Next Economy, thereby beginning with end goals firmly in mind. This involved identifying and evaluating the sectors, industries, and companies advancing development in each of the Four Pillars of Sustainability—economic productivity gains, renewable energies, waste-to-value supply chains, and increased social cohesion.

Visit the Investment Process page to learn how we:

- research systemic risks,

- evaluate potential solutions to those risks,

- analyze potential industries where those solutions might be deployed at scale,

- analyze potential companies in which to invest, and then

- build institutional-quality portfolios from that solution set.