Deprecated: Creation of dynamic property SocialSharing_Shares_Controller::$models is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/vendor/Rsc/Mvc/Controller.php on line 28

A fundamental part of our process is looking at how a company is paid.

To be considered for full evaluation, a company’s output – it’s product and service mix – must be doing more to solve for than contribute to systemic risks.

Investing in an Unconstrained Opportunity

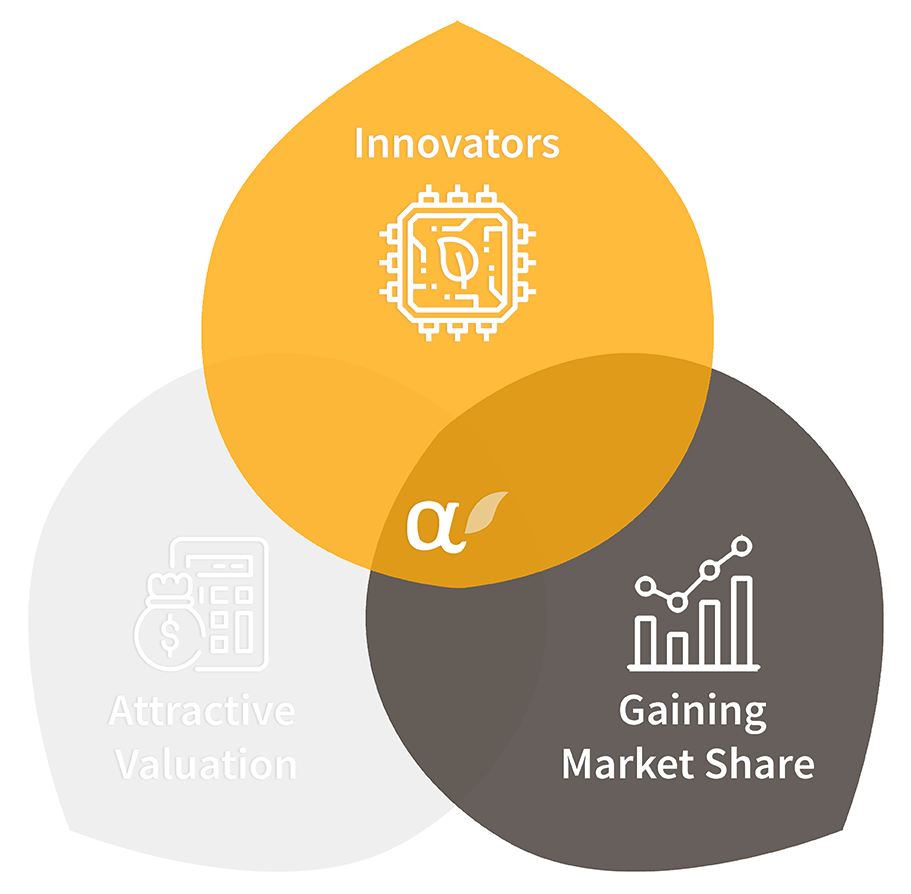

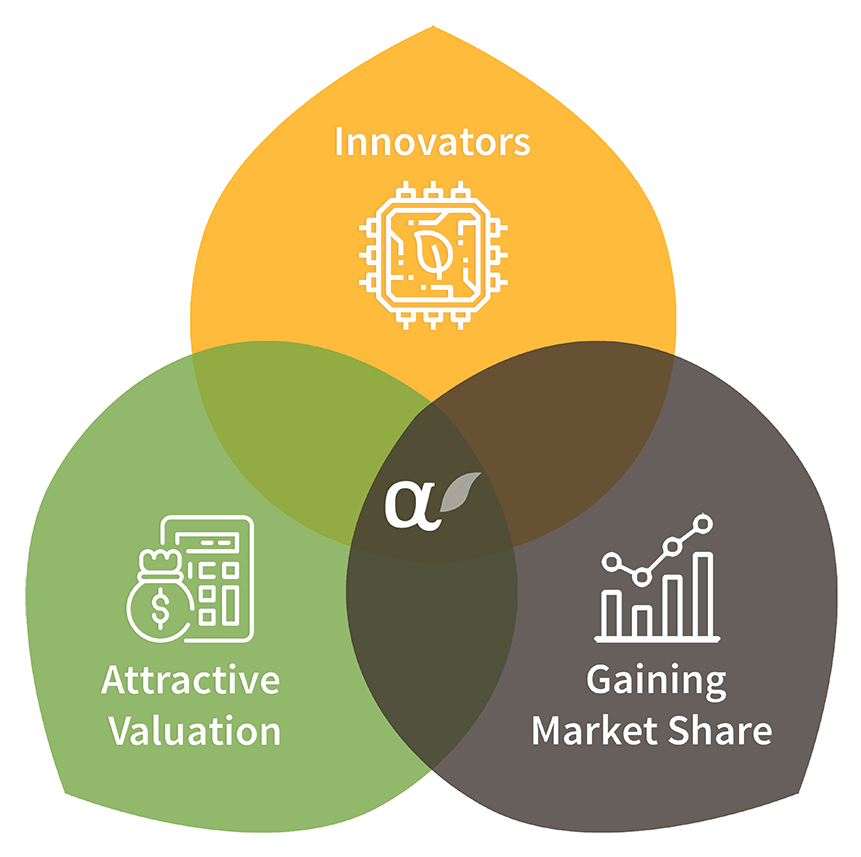

Our investment team applies the Next EconomicsTM philosophy by developing an investment universe of publicly traded companies that are creating or enabling solutions to major systemic risks like climate change, resource scarcity, and widening inequality. Our investment team then identifies and invests in the leading Next Economy companies with strong leadership teams and business metrics, while also seeking attractive current valuations for client purchases.

Because our team begins the investment process by examining economic risks and opportunities at a systemic level, rather than using a traditional list of index constituents as the starting point, the Next Economy investment approach is fundamentally unconstrained. We will select compelling sustainability drivers wherever they can be found. The investment team searches for companies that are tackling major risks across geographic regions, economic sectors and industries, and market capitalization sizes. We believe this solutions-based investment approach is an effective way to preserve and grow long-term capital for our clients.

To identify Next Economy portfolio companies, our investment team includes two separate components: top-down and bottom-up analysis.

Top-Down Analysis

Identifying Next Economy Solutions Creators and Enablers

The first step in our investment process is to identify the innovative companies that are creating and enabling Next Economy solutions. If a company does not pass this top-down stage, it will not proceed to the bottom-up stage. The top-down stage involves the following specific steps:

- Evaluate the most objective and persuasive assessments (e.g. scientific research) of critical systemic issues confronting the global economy

- Rigorously research new technologies and business practices that address these systemic risks

- Assess innovative approaches to risk mitigation and adaptation that can be practically deployed, selecting those with the potential to scale rapidly, and understand how they fit into particular sectors and industries

- Identify companies that are proven as effective leaders with defensible business positions, based on factors including: intellectual property (IP), history of driving revenue growth, record of margin expansion, sufficient business reinvestment and R&D, and superior productive efficiency

- Determine the percentage of each company’s revenue that is attributable to delivering Next Economy solutions to identify whether solutions are sustainable core revenue drivers for the company

- Populate the Next Economy Universe with companies that successfully meet these criteria

Bottom-Up Analysis

Evaluating Next Economy Candidates’ Business Models and Financials

The second step in our research process is assessing the financial and operational condition of companies that have met our top-down, Next Economy criteria. We apply rigorous quantitative financial analyses, which are based on the Graham and Dodd value investing methodology, to identify the Next Economy companies with the strongest financial positions and long-term growth expectations, all within acceptable levels of risk. The bottom-up analysis includes these steps:

- Identify candidate companies with high-functioning business models, as demonstrated by a combination of the following criteria:

- Diversified and predictable revenue streams

- Consistent track record of delivering revenue growth, margin expansion, earnings, and dividend growth (where applicable)

- Visible path to continued growth

- Strong and expanding cash flow

- Healthy balance sheet

- Effectiveness, diversity, and cohesion of the leadership team, and board of directors

- Determine if the company’s stock has a compelling valuation (i.e. reasonable or undervalued share price relative to the company’s underlying value, industry peers, and expected future growth), exhibited by:

- Moderate price/book ratio

- Moderate price/sales ratio

- Moderate forward price/earnings

- Revenue and earnings growth that justify these multiples

The Result: Next Economy Portfolio Candidates

Our investment process is designed to identify portfolio companies that exhibit sound financial management and have business models that address one or more of the systemic challenges facing the global economy.

The companies that successfully pass our research analyses are candidates for Green Alpha portfolios, because they are driving the transition to the Next Economy with compelling products, strong business models, and opportunities for above-market growth.

While all of our portfolio constituents result from this process, each portfolio has its own unique investment goals and construction methodology. To explore the similarities and differences among the portfolios, visit the Investment Portfolios page or Contact us to have a conversation.