Deprecated: Creation of dynamic property SocialSharing_Shares_Controller::$models is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/vendor/Rsc/Mvc/Controller.php on line 28

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

By Garvin Jabusch, CIO.

The World Economic Forum (WEF) creates an annual list of the top economic risks facing the world over the coming year, two years, and 10 years. Green Alpha Investments regularly uses these lists and associated interconnection diagram as risk management inputs as we implement our processes to manage risks that matter.

During the unveiling of this year’s list at WEF’s annual meeting at Davos, the organization dropped a new bit of descriptive vocabulary: the “polycrisis.” To be clear, the world has been in a state of polycrisis for some time, so the risks and threats themselves are not new, and yet, this new bit of jargon does serve to crystalize a key point: our problems are interconnected and mutually exacerbating. Meaning, it may be of limited use to focus on one at the expense of others.

Chronic Underinvestment in Solutions

And so, when we think about indefinite economic and ecological sustainability, we can’t mechanically think about just net zero; we have to think about every industry, not just energy and transportation, and we have to think, to the extent that we can as asset managers, about all the problems affecting the world that innovation and capital can help fix.

This means, to borrow from the work of Daniel Kahneman, that we must conduct a premortem into the risks with the potential to derail the global economy over the coming decade. In conducting this analysis, we can learn the economy’s existing and coming pain points, and get it front of the required solutions relatively early.

If we seek an economy that can thrive indefinitely, we must invest in and dramatically scale up the means of production that put an end to the causes of these risks. This must occur across sectors, industries, international borders, and capitalization sizes. It is chronic underinvestment in these fixes, and overinvestment into the sources of our problems, that has led us to this precarious point of polycrisis, and only reversing this dynamic has the power to reverse the situation.

Asset Management’s Critical Role

The entrenchment of the asset management industry in favoring the legacy economy is significant. Even today, with the dangerous effects of the climate crisis already upon us, 2022 saw global investment in new fossil fuel exploration that was the equivalent of investments in renewable energy generation, with both ringing in at approximately $1.1 trillion dollars for the year. While this is a dramatic improvement over past years, and indeed was the first time renewables received as much investment as fossils, it is still far short of the scales that will be required to avert 2°C of cumulative warming, and, not to sugarcoat it, science is currently indicating that 2° is probably our happiest ending at this point. IPCC has warned us of this in its recent document Climate Change 2022: Mitigation of Climate Change (Chapter 15), saying, “Progress on the alignment of financial flows with low GHG emissions pathways remains slow. There is a climate financing gap which reflects a persistent misallocation of global capital (high confidence). Persistently high levels of both public and private fossil-fuel related financing continue to be of major concern despite recent commitments.” IPCC added, in a separate release, “The scientific evidence is unequivocal: climate change is a threat to human wellbeing and the health of the planet. Any further delay in concerted global action will miss a brief and rapidly closing window to secure a liveable future.”

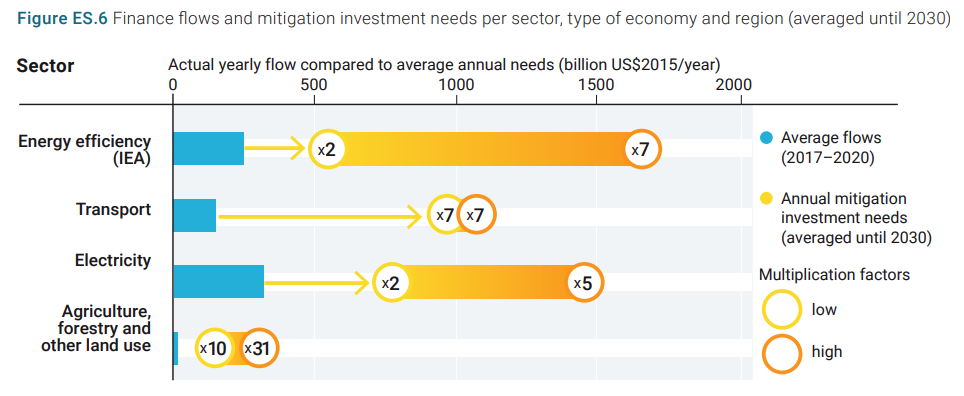

The investment shortfall they refer to is large. IPCC’s Emissions Gap Report 2022: The Closing Window shows the world is many multiples behind in the dollars required to prevent warming greater that 2C.

It seems reasonable, although WEF did not do so, to suggest that capital allocation priorities on the part of the world’s asset managers is a major, if not the major, driver of the polycrisis. Of course, there are many reasons for this, and most would sound reasonable if not for the scale and severity of the likely outcomes of ongoing investing in our most destructive production functions.

Also not listed by WEF, but surely as dangerous as almost any other, is status quo risk. The single greatest danger we face in investment management is that of the status quo, or the argument that that’s just how things are, that we must keep holding on to yesterday. Yes, entrenchment has always been the preferred strategy of incumbents, but today this bias is particularly dangerous. People will generally concede that new things can be good, unless those same people are already killing it doing the old thing. But the old thing is now killing us. The past is no longer a sufficient template for where we’re headed. Status quo bias in the asset management industry is accelerating the polycrisis.

And yet there are attractive, exceptional, investments that don’t occur on the list of premortem problems currently undermining global economics. Climate and ecology aren’t the only areas where there are tipping points, innovation and technology also have equally massive tipping points, although markets are slow and reactive in appreciating either. Markets don’t anticipate this exponential future very well.

A stock is usually only meaningfully bid up once its business case is a fait accompli; therefore, in this time of fast and accelerating tech and economic change, past a horizon over a year or two, there’s a remarkably high chance for markets to be wrong. All of which is to say, we need a new status quo, a theory of portfolio management that is designed to overcome the world’s shortfalls of vision. On this basis we at Green Alpha looking ahead to a reality that is emerging, that is going to continue to emerge, and that isn’t priced into a given stock yet.

Contrarians No More

In the current climate, we therefore need to be both contrarian and right. And this is where there is good news: the real environment and the financial environment are both now moving in our favor. We can find standout companies growing much faster than underlying GDP by starting with a simple question: is this company solutions oriented or destruction oriented? (And no, unfortunately ESG scores don’t help inform this analysis.) We believe this provides a premise for a doctrine of a unified approach to investing in real and indefinite economic (also meaning environmental) sustainability. If a company’s net activities do not create a better world on an ongoing basis, we should perceive it as too risky and decline to own it. Because the causes of the polycrisis will not define the future, they will not where forward returns will come from, and they certainly do not represent impact. The status quo’s rules mandating investment diversification into the causes of crises don’t matter anymore.

As the sustainable economy transition progresses, national and global economic production will become much greater than they are today, while using far fewer inputs (be those inputs natural resources, person hours or dollars), and while creating far fewer costly and risky externalities like greenhouse gasses and other pollutions. As these companies of the Next Economy gain market share and grow their revenues, earnings, and market caps, our approach will appear less innovative over time, and our active share will slowly decline. Meanwhile, there are dozens if not hundreds of opportunities to benefit from the transition.

For asset allocators, the winning factor from now on is to figure out what will enable the human economic production function to work phenomenally well, indefinitely, without overtopping planetary tolerances, and then to own as much of the related IP and production capacity as possible. This of course will create enormous wealth for investors and get us on the path to indefinite sustainability, meaning a good standard of living for everyone, without exceeding underlying climate tipping points. And that’s our endgame: investing to realize a de-risked economy. Keeping our eye on the endgame while avoiding the traps revealed in the premortem analysis is how we manage portfolios.

At Green Alpha we believe that if we can let go of our belief in how we are “supposed to” do things, then anything is possible, and that high active share is for now the best approach; meaningful innovation in any industry is often not very conventional. We, like WEF, are engaged in managing the risks that matter. Tomorrow’s economy is the direct output of today’s investments, but, so far, investors are not appropriately internalizing how bad climate change is going to be, and so markets are misallocating capital. This is risky because, in the scope of history, now is our only time to prepare and react. There’s really only one way for us to navigate our way through the polycrisis: invest at scale in the alternatives to its causes.

###

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/