By Helen Lombardo.

ESG refers to the criteria used to evaluate the strength of an investment opportunity’s environmental, social, and/or corporate governance quality. Its goal is to help a socially conscious investor filter potential investments. In and of itself, not a bad objective. Entities like the PRI (Principles for Responsible Investing), a UN-supported network of investors, and many third-party providers of ESG rating systems have arisen to assist investors in their research. In doing so, they also impart cachet to the use and governance of these criteria; if the UN approves of it, it must be trustworthy. As with most things, ESG ratings and their application aren’t black and white. While the ratings can relay meaningful information, in some situations, these factors also gloss over how truly sustainable a company and their practices are.

Pieces of the Puzzle

At their heart, ESG factors and ratings are meant to help investors evaluate if a company’s policies and actions align with economic, social, and/or environmental goals; do they address risk factors or play into them? Companies like MSCI and Sustainalytics (which use letter, AAA-CCC, and number, 0-40+, scoring, respectively) collect public data on a company’s industry risks related to ESG factors, which are then compared to peers to generate ratings in an attempt to answer this question. Generally, a better (higher letter or lower number) score will indicate that a company is doing a good job addressing sustainability issues. But to stop there misses the bigger picture.

The accountable investor must ask themselves: what data does a third-party provider of scoring really look at; how do they define the factors they use? MSCI notes their ratings measure only “… a company’s resilience to financially material environmental, societal and governance risks.” Meanwhile, Sustainalytics ratings measure “a company’s exposure to industry-specific material ESG risks and how well a company is managing those risks.” Bloomberg’s scores are produced using a proprietary quantitative model to rank performance across several areas of focus. In other words, there are no industry specific guidelines which govern what data or definitions should be used, let alone what rules managers should utilize when constructing portfolios.

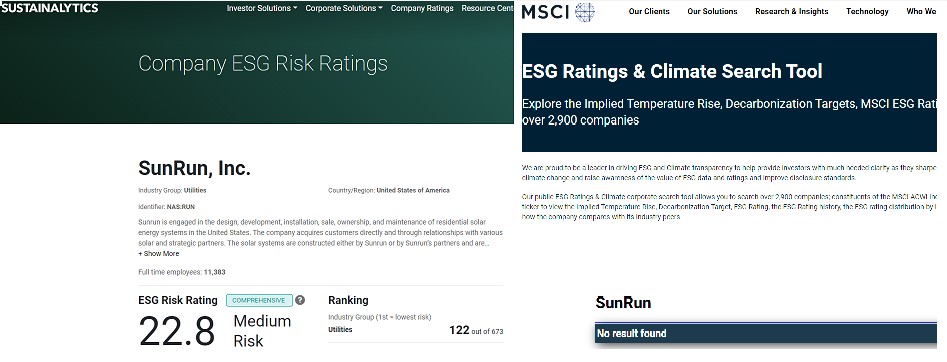

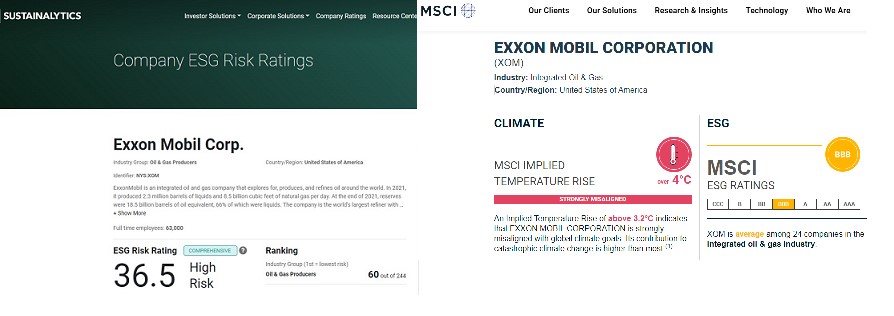

Another piece of the puzzle to consider is ratings as they compare between investment opportunities. Scientists and activists alike have raised the warning that fossil fuels use imposes major cost on the environment, climate, and overall health. And yet, it is not unusual to find oil and gas producers rated comparably to companies known to embrace more sustainable measures. For instance, Shell PLC received a 34.7 rating from Sustainalytics; Tesla received a 28.6. Exxon Mobil has a 36.5 rating, while Enphase Energy, a global supplier of microinverter-based solar and battery systems, scored a 29.0; SunRun, Inc., a provider of solar energy generation and storage systems, scored a 22.8; and TPI Composites, an advanced materials/composites maker serving wind turbine manufacturing, scored 16.5. Even using MSCI’s rating, we see comparable scores: Shell PLC received AA and Tesla A. Relying solely on the ratings, one would assume that these oil and gas companies are nearly as eco-friendly in their practices as companies fully embracing solar and electric technologies.

Further, one might also presume that since the ESG ratings system exists, all investable companies, especially those within sustainable industries like solar power, are rated across all third-party scoring. As it turns out, rating organizations may not be uniform in the application and use of policies and ESG factors.

SunRun is rated by Sustainalytics, but not by MSCI.

Meanwhile, Exxon Mobil appears on both rating systems.

Again, because ESG ratings were created to assess how a business’s model and commitments tie to sustainability goals, it is easy to suppose that ESG ratings also inherently measure a company’s efforts to positively affect society’s pressing issues—when in fact they don’t. Tesla echoed this thought in their 2021 Impact Report stating that “current environmental, social and governance (ESG) reporting does not measure the scope of positive impact on the world. Instead, it focuses on measuring the dollar value of risk / return. Individual investors—who entrust their money to ESG funds of large investment institutions—are perhaps unaware that their money can be used to buy shares of companies that make climate change worse, not better.” MSCI lays out the scoring conundrum perfectly when explaining their ratings “are not a general measure of corporate ‘goodness,’ a barometer on any single issue or a synonym for sustainable investing.’”

A New Perspective

So, what’s a reasonable and responsible investor to do? We suggest a change in perspective. ESG ratings ask the investor to trust that what is important to them is also important to the rating system. As discussed earlier, every rating system uses a different, though perhaps somewhat adjacent, model. Models which rate a company’s ability to manage industry specific ESG risks, not what efforts are being made toward a solutions-focused, risk-mitigating economy.

At Green Alpha, we have never subscribed to the use of ESG ratings for the very reason that the factors within may or may not address the growing systemic risks—such as climate change, resource degradation, and widening inequality—which put the economy in jeopardy. Our approach is to re-conceptualize the “impact portfolio” by looking for companies driving progress to a fully sustainable economy, while creating and preserving wealth. Every stock is individually evaluated to determine whether it contributes to systemic risk or offers solutions to it. Green Alpha believes that when investment opportunities are viewed through the lens of their ability to contribute to an efficient, innovation-driven future economy, to rely on ESG ratings only serves to minimize their potential impact.

Disclosures:

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC. Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice.

At the time this article was written and published (August 18, 2022), some Green Alpha client portfolios held long positions in Tesla (ticker TSLA), Enphase Energy (ticker ENPH), Sunrun (ticker RUN), and TPI Composites (ticker TPIC). These holdings do not represent all of the securities purchased, sold or recommended for advisory clients. You may request a list of all recommendations made by Green Alpha in the past year by emailing a request to any of us. It should not be assumed that the recommendations made in the past or future were or will be profitable or will equal the performance of the securities cited as examples in this article. Not all Green Alpha separate accounts or our sub-advised mutual fund held the stocks mentioned. To inquire whether a specific Green Alpha portfolio(s) holds stock in any particular company, please call or email us.

At the time this article was written and published, Green Alpha did not hold client assets in Shell PLC (ticker SHEL), Exxon Mobil (ticker XOM), or MSCI Inc. (ticker MSCI).

Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/