This summer we executed our annual rebalance of the Next Economy Index portfolio—which serves as both empirical compendium and basis for an investment strategy—and we find ourselves in possession of an enriched framework for thinking about the trajectory of the economy.

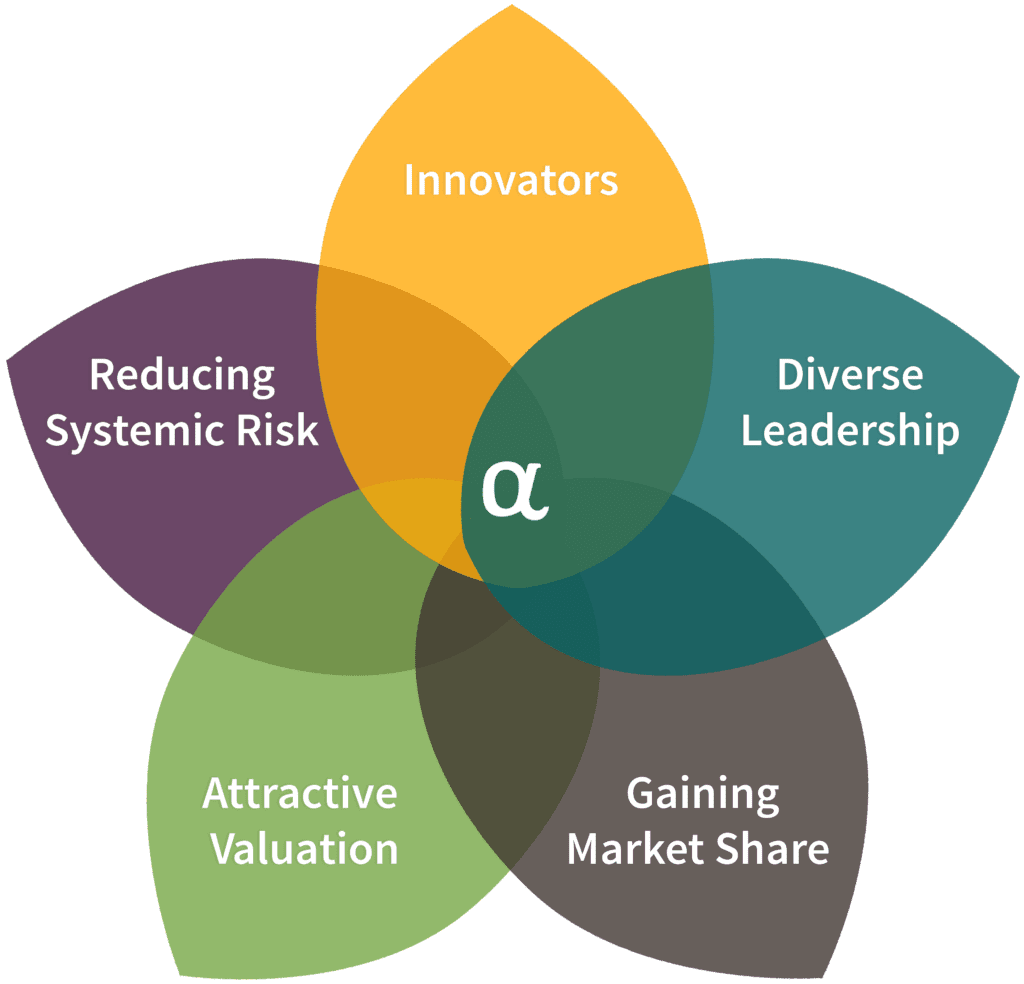

Green Alpha’s Next Economy Index is a carefully curated list engineered to encapsulate corporations that act as enablers and catalysts of economic perpetuity. Keeping this roster up-to-date both requires and results in us enhancing our analytical framework for understanding the evolutionary development of what we refer to as the ‘Next EconomyTM.’ By adding innovative companies that are driving meaningful change and removing those that no longer align with our stringent criteria, we’ve this year not only expanded our portfolio, but also fine-tuned our insights into the emerging paradigms that define the Next Economy. This strategic recalibration serves as both an investment guide and a compass, orienting us toward a future where the possibility of indefinite growth and economic stability are intrinsically linked.

Before we set some economic context for our various decisions, the technicalities of the rebalance are as follows: stocks of 29 new companies were added to the portfolio and 21 removed, for a net gain of eight positions and a new high-water mark of 151 unique equities. The new positions increase diversification of the portfolio in absolute terms via total number increase and also in sector and industry terms, as we added to six industries and introduced one industry that was previously not represented.

It is encouraging to contrast 151 equities now with 63 that passed our rigorous criteria when we launched the portfolio strategy at the end of 2008; by this measure an indefinitely sustainable economy appears to be making headway and gaining investment allocation and underlying business market share away from its more destructive, legacy predecessor. Further, the Next Economy Index first had 27 industries within 9 sectors represented. Today we have found compelling, quality, investible candidates in 11 sectors and 33 industries.

We talk amongst ourselves each year about what has and hasn’t changed since founding Green Alpha and launching this, our first portfolio strategy under the Next Economy framework. This article is in part meant to share the conversation outside of our walls.

Uncompromising Research Creates Targeted Results

As ever, Green Alpha’s research methodology is engineered to identify companies that significantly de-risk the global economy through transformative mechanisms. These organizations do not merely add to economic productivity; they catalyze it. They are central players in the electrification of diverse sectors, the large-scale decarbonization of the economy, and the strategic dematerialization of resource-intensive industries. Further, these companies are taking targeted steps to alleviate economic drag and measurably enhance societal well-being, via addressing human disease burdens both directly, and via addressing their causes, such as fossil fuels’ emissions, and therefore contribute to a global civilization that is more equitable and just.

Rigorous Financial Criteria

Equally importantly, our selection of these companies is rigorously framed within a stringent set of financial criteria. The organizations we approve for investment in client accounts exhibit superior economic competitiveness, fortified by investment-grade fundamentals. We seek business track records that demonstrate a consistent expansion in market share, widening profit margins, improvement of free cash flow, and an overall growth rate that significantly outpaces underlying Gross Domestic Product (GDP).

This is not an exercise in mere speculation, but a well-anchored strategy rooted in quantitative and qualitative analysis. When it comes to preparing for the inevitable economic uncertainties of the future, nothing less than this level of precision and foresight will suffice.

Navigating Complex Risk Landscapes

Finally, let’s acknowledge the multifaceted risk landscape within which we operate. The predominant investment risks we face today are not just financial, but also systemic and planetary in scope. These include the urgent threats posed by the climate crisis, geopolitical instability—such as rogue states with nuclear capabilities—degradation of natural resources, and the surge of nationalism fueled by increasing social and economic inequality. Traditional risk management approaches, such as monitoring asset volatility and correlation with arbitrary benchmarks, are insufficient in this context. If the goal is to not just preserve but also grow wealth, then our risk management strategies must adapt to and address these clear and immediate economic challenges.

With this foundation, let’s set the stage for an exploration of the evolving paradigm of the Next Economy and results of the 2023 rebalance.

Our annual rebalancing procedures, which are a yearlong undertaking (already underway for the 2024 cycle), serve as a crucible for discerning substantive evolutions within what we rigorously define as the ‘Next Economy.’ This is not a term employed with imprecision. Rather, it delineates an economic model endowed with the inherent resilience vital for enduring not just systemic threats, but also challenges that impact our planet on a geological scale, such as transgressing defined planetary boundaries. Next EconomicsTM isn’t just a hypothesis or catchphrase; it is an axiomatic principle that functions in alignment with systemic risk mitigation. This is brought to fruition not solely by means of technological innovation—which is, of course, a pivotal factor—but also manifests through judicious business planning and operational execution.

Thus, the scope and rigor of our approach go beyond superficial metrics, offering an authoritative analysis grounded in comprehensive understanding and forward-thinking strategies. So, what can we make of the empirical manifestations of this evolving paradigm?

A Bifurcated Response to Progress

The assessment of the Next Economy in 2023 yields a complex, bifurcated picture. While there is demonstrable progress towards sustainable abundance, that coexists with significant stagnation and even regression in key areas. Some steps forward, some steps back.

Climate Crisis and Energy Transition

Beginning with the primary driver of the climate crisis, the first and perhaps most important thing to observe is that global energy demand is growing rapidly enough that fossil fuels and renewables are both adding capacity. Certainly, renewables are slowing the growth of fossil energy, both in transportation, due to EVs, and in electrical generation, thanks primarily to rapid development of solar and wind solutions, but fossil fuels persist in displaying a growth trend in absolute terms. The year 2023 looms as a new high in anthropogenic greenhouse gas emissions, exacerbating the entropic decay of the planet’s homeostasis. Noteworthy commentators, such as Gregor MacDonald, offer crucial insights into these disquieting phenomena, and we recommend following his substack.

The Persistence of Fossil Fuels’ Growth

Why, in 2023, with the climate crisis clearly upon us, do we still see significant growth in fossil fuels? Inertia and status quo bias are at work here, certainly, but crucially, so are capital flows. The tenacity of fossil fuel proliferation owes its obdurate persistence to a grossly disproportionate allocation of capital investments, as underscored by analysts like Nat Bullard at Bloomberg. While it has been frequently (if not precisely) reported that capital investments into renewables and fossil fuels last year (2022) was roughly equivalent, at 1.1 trillion dollars each, Bullard points out that global subsidies to fossil fuel industries dwarf both figures put together, at something around 7 trillion dollars. In other words, between direct subsidies, indirect subsidies, and direct capital investment, fossil fuels are still receiving over 8 trillion dollars in annual investment, which, if you’re keeping score, is about 8% of global GDP. This is a shocking observation to contemplate as the world heats up and becomes more volatile.

In light of this perpetuation of the long, golden age of growth in fossil fuel exploration and development, it shouldn’t surprise that BP is walking back its climate pledges and ExxonMobil says current global climate goals won’t be met, and that oil and natural gas will still be 54 percent of the world’s energy mix in 2050. These oil majors may be right; after all, it is axiomatic in economics that tomorrow’s production function emerges directly from today’s investments, so as fossil development receives the lion’s share of capital today, that presages a fossil-fuels led world of tomorrow. To be clear: these subsidy-level interventions in the fossil economy serve a financial architecture that was built for a different era, but one that persists now in the form of economic and political power that is not easily undermined, even where these subsidy interventions introduce significant global risk to asset values and even to life.

The Imperative for a Climate-First Investment Approach

This financial disproportionality is symptomatic of a larger, institutional lethargy and is among the motivations, along with competitive performance seeking, driving Green Alpha’s unwavering commitment to an uncompromising ‘climate-first’ investment methodology. This ethos distinguishes itself markedly from mainstream Environmental, Social, and Governance (ESG) paradigms. The pre-qualifications for inclusion in our portfolios stipulate that a prospective corporation must exhibit a substantive net positive impact in efforts to decarbonize, dematerialize, or electrify the global economy, thereby mitigating existential threats, de-risking the economy for all participants.

Context thus established; it’s illuminating to next delve into the changing composition of the Next Economy Index. Not just an overview, it’s about understanding the evolving fabric of what we term the ‘Indefinitely Sustainable Next Economy.’

A Lot of this is about Energy and Transportation

Although fossil fuels and internal combustion vehicles continue to receive vast investments and are still the default options available to most consumers, it is now plain that these old technologies are globally losing market share at the margin.

EV sales growth, key to electrification and decarbonization (in addition to reduction of deadly pollution), have recently begun to accelerate and are projected to grow further into the foreseeable future.

IEA reports that “Electric car markets are seeing exponential growth as sales exceeded 10 million in 2022. The share of electric cars in total sales has more than tripled in three years, from around 4% in 2020 to 14% in 2022. EV sales are expected to continue strongly through 2023…resulting in a 35% year-on-year increase.” This is fast enough that internal combustion has measurably lost market share. According to CleanTechnica, “In 2017, 86 million internal combustion passenger vehicles were sold, including traditional hybrids like the Toyota Prius. Battery electric and plug-in hybrid models accounted for just over 1 million sales combined. Sales of cars powered by internal combustion engines were down almost 20% from that peak to 69 million in 2022, while plug-in vehicles sales increased to 10.4 million.”

Calling peaks and troughs is never a good idea, but 2017 is now far enough in the rearview mirror that we might begin to feel comfortable that that was internal combustion’s summit.

In energy, as may be obvious from the capital allocation scenario described above, the picture is more complicated. According the S&P Global article “Fossil fuels ‘stubbornly’ dominating global energy despite surge in renewables,” “Global primary energy consumption grew by 1%, with global oil consumption rising almost 3 million b/d to 97.3 million b/d in 2022…Together with gas and coal, fossil fuels made up 82% of the global energy mix.”

Oil, gas, and coal have been stuck at about 82% of the primary energy mix for several years now, despite the rapid rise of renewables. Getting that number to budge is going to require more investment capital flowing to renewables and electrification, and less to fossils.

But again, renewables are now capturing marginal share. Per IEA: “Global renewable capacity additions are set to soar by 107 gigawatts (GW), the largest absolute increase ever, to more than 440 GW in 2023.” And yet, “At the same time, electricity generated from fossil fuels is expected to decline over the next two years. Electricity generated from oil is projected to fall significantly, while coal-fired generation will slightly decline in 2023 and 2024, after rising 1.7% in 2022,” also according to IEA in a separate article.

For both fossil energy and fossil transportation, losing marginal share is still losing market share. As a result, EV and renewable energy are growing faster than the fossil competition, albeit from smaller bases. In the case of fossil energy, absolute growth continued in 2022, but new watt hours of dispatchable capacity are adding up more slowly than they are for renewable sources. For vehicles, we may have already passed peak internal combustion sales worldwide.

Of course, the two industries are of a piece, and we can take some comfort in the fact that as EV sales create new electricity demand (at the expense of oil demand), the rapid addition of renewables to the grids of the world’s largest economies means that electric drivetrains aren’t contributing additional greenhouse gasses to the atmosphere past what they would have before renewables began to accelerate in earnest (see chart).

Stock Selection in Energy and EVs

In terms of stock selection, this all means that the medium- and long-term growth in energy and transportation overwhelmingly belong to EVs and renewables, including energy storage, even though these industries are in minority positions today. New additions to our Next Economy Index included 10 new companies we deemed to be respective leaders in:

- passenger and commercial electric vehicles, including two-wheeled, four-wheeled, autonomous, and aviation-capable vehicles,

- short-term dispatchable and longer-term energy storage technologies, including newer battery chemistries and architectures, as well as

- additional investments in companies enabling continued performance and cost progress in these areas, such as integrated circuit designers and AI applications.

Although we already had considerable exposure to these areas, we are pleased at the emergence of these competitors, as it is usually advantageous to invest in a basket of the market and intellectual property leaders in any field. Together, the energy and transportation exposures in the Next Economy Index represent approximately 19% of the portfolio as of early September 2023, as befits their proportionate participation in the economy.

Equally important to the quality and forward-looking nature of the Next Economy Index is what we chose to remove from the portfolio during the rebalancing process. Within energy and transportation, we removed one company, an EV charging network provider. We don’t take full removals lightly at all, and sold the position for a variety of reasons, including lack of faith in management’s ability to execute, increasing competition in the space, and poor sustainability of operations that includes no solar power usage or other carbon reduction goals or activities.

Overall, with respect to slowing the climate crisis, the world’s energy and transportation mixes must not only continue on the path to decarbonization, but accelerate, which can only occur via increasing the velocity of capital flows. Green Alpha has no exposure to any fossil burning power generation, nor to any internal combustion engine manufacture.

But it’s Not All about Energy and Transportation

And yet, every sector and industry in the global economy must come to operate on an indefinitely sustainable basis if our collective goal is to live in a world that has been sufficiently de-risked to ensure our ability to thrive on a long-term basis. Moreover, many of the most interesting and exciting solutions to some of the largest structural and economic problems confronting the world today are found in industries we might not consider from superficial sustainability analyses.

New Next Economy Index constituents from sectors other than energy and transportation are an interesting group, as illustrated by the following select examples.

Stock Selection in Health Care and Related Solutions

Within the health care sector itself, we added seven new companies and removed one, broadening diversification of the portfolio investments across several variables.

Of interest to us is the ongoing confluence of biotech and AI. New portfolio constituents in this realm include:

- A company using a custom-tailored large language model (LLM) to investigate the potential effects of huge numbers of small molecules upon different disease pathologies, completing daily what just a few years ago would have taken a human researcher years and thereby greatly accelerating the process of drug discovery.

- We also added shares of the world’s only publicly traded protein sequencing company. Protein sequencing is distinct from gene sequencing in that protein sequencing analyzes the amino acid sequence of proteins while gene sequencing analyzes the nucleotide sequence of DNA genes. The former reveals details on protein structure while the latter reveals the genetic code for making those proteins. Determining amino acid sequences gives molecular-level insights into protein behavior and interactions to facilitate many applications in biotechnology, medicine, evolutionary biology and more. The scale of interdisciplinary applicability of this technology, and the fact that the company is for now the sole provider, makes a compelling investment narrative.

Elsewhere in the biotech space, we added:

- A leading company that specializes in synthetic biology. They work with microorganisms like yeast and use genetic engineering to make these tiny organisms produce useful products. The scope of their work is broad and impactful, touching everything from creating flavors and fragrances to optimizing medical drugs. They’re also making strides in agriculture by developing microbe-based coatings for seeds to improve crop yields. During the COVID-19 pandemic, they produced synthetic viral RNA to help with testing shortages. Additionally, their innovations are driving progress in the biofuels sector. Suffice to say, their microscopic manipulations are yielding macroscopic impact across various industries.

- Two gene-editing based biotechs working to address cancers, heart disease, and more of the world’s leading causes of morbidity and death.

In medical technology, we added:

- A company that has developed a handheld ultrasound device that is unique in several ways. It is the first handheld ultrasound device that uses semiconductor technology, making it more affordable (the company’s mission to democratize medical imaging), it is easy to use, making it possible to bring ultrasound imaging to more people, including those in rural and underserved areas, and it provides high-quality images that are comparable to those produced by traditional ultrasound devices. This makes it a valuable tool for healthcare providers.

We removed one biotech, a company focused on developing regenerative medicine therapies via allogeneic stem cell treatments derived from human bone marrow. It utilizes mesenchymal stem cells to modulate immune response and facilitate tissue repair. The technology is being tested for treatment of neurological conditions like ischemic stroke, ARDS induced by COVID-19, and traumatic brain injury. Also being explored for ulcerative colitis. However, the company has been slow to realize this potential for several key reasons that together worked to undermine our investment conviction:

- Clinical trial delays – the stem cell therapy has for years been in clinical trials for treatments like stroke and COVID-19 induced ARDS. But these trials have faced slow enrollment and delays, pushing back potential approval timelines.

- Unclear regulatory path – The regulatory path for approval of stem cell therapy remains uncertain, especially for newer indications like COVID-19. This lack of clarity adds risk.

- High cash burn – Development of stem cell therapies requires extensive R&D spending. The company has reasonably continued to burn through cash at a high rate, but with slow trials and a challenging regulatory environment combining to add potentially years to the time when the company realizes product revenue, the cash burn appears unsustainable.

- Partnership setbacks – the firm has failed to secure a major partnership for development and commercialization, losing out on an opportunity to validate the technology and get external funding.

Stock Selection in Technology

Within the technology sector, we added exposure to a robotic and systems automation software company, as core to our thesis is the importance of never-ending economic productivity gains to dematerialization and therefore to sustainability. Productivity gains of course also create wealth and make firms more competitive.

We added a free, high quality, app-based language education company that provides meaningful skills to anyone with a smartphone. The company is also quite profitable and more than competitive with traditional pay-for-play coursework providers.

We also newly added the leading provider of electronic design automation (EDA) software and services. EDA software is used to design, verify, and test integrated circuits. A key component of Green Alpha’s Four Pillars of Sustainability framework is the fact that to provide the global population with a reasonable standard of living without overtopping Earth’s carrying capacities, we need the economy to operate far more efficient than it does today. Producing and manufacturing the most efficient integrated circuits is critical to achieving that.

Stock Selection in Food, Beverage, and Household Products

In food and beverage, we added additional exposure to natural and organic farming as well as to consumer discretionary and staples product manufacture and distribution. These solutions and new companies in the portfolio are an important piece of the global de-risking puzzle, as organics involve reduced fossil-fuels-based fertilizer use, increased carbon sequestration, lower nitrous oxide emissions, higher water retention, and often better energy efficiency.

In the past we have had a hard time finding household products companies that meet all the criteria we require to be approved for our investible universe, so we were very pleased to be able to add that diversification this year by approving a household products manufacturer that focuses on all-natural baby products, skin care, home cleaning, and other wellness products.

Strong Sell Discipline in Action

When we see deterioration in key criteria that must be in place for us to make a new investment or continue holding an existing investment, we take a hard look at all the facts and sometimes have to exit formerly approved companies. As mentioned above, we exited 16 companies in this year’s Next Economy Index rebalance, so those companies are no longer eligible for any Green Alpha portfolio. Rationale for the change in investible status included:

- Poor capital allocation priorities by management and the board of directors – spending too much on share buybacks that redirects investment dollars away from critical functions like research and development and capacity expansion.

- Management’s inability to execute on business-as-usual operations or a turnaround plan (such as the stem cell biotech mentioned above).

- Increasingly unclear path to market share growth, cash flow generation, and/or profitability.

- New management team’s abandonment of formerly-core sustainability values and activities.

- Company resting on their laurels on sustainability efforts – because what was good enough five years ago isn’t good enough today; corporations must keep increasing goals and results if one of the reasons they’re in the portfolio is that they are a sustainability leader in how they produce their products.

Taking Everything into Account

The annual recalibration of Green Alpha’s Next Economy Index serves not just as a portfolio adjustment but as a barometer for the unfolding narrative of global economic transformation. Our meticulously curated portfolio of 151 equities across a myriad of industries, bolstered by the inclusion of 29 new pioneering enterprises, reveals a larger through line: the Next Economy is not an abstract concept, but a dynamic, evolving ecosystem. It is a crucible in which innovation and sustainability are not merely aspirations but operational imperatives.

In further diversifying our portfolio, and the client accounts invested therein, we are emphasizing the importance of the energy and transportation sectors as pivotal levers for large-scale decarbonization. With roughly 19% of our portfolio geared towards these sectors, we acknowledge the urgent need to expedite the transition to a decarbonized global economy. However, we also understand that decarbonization is not a one-dimensional challenge. Therefore, we have expanded our scope to include companies in biotechnology, medical technology, education, and even household products that exemplify transformative potential.

We believe that the path to a sustainable future is a multi-lane highway. On one hand, we are investing in companies accelerating the pace of drug discovery through the confluence of biotech and AI, thereby transforming our approach to addressing disease. On the other hand, we hold shares in organizations that utilize synthetic biology to address real-world challenges, ranging from agriculture to biofuels. These companies are pioneering frameworks for a future where economic growth and societal well-being are inextricably linked.

Moreover, the financial fortitude of the companies in our portfolio is a testament to the viability of sustainable business practices. Superior economic competitiveness, robust market share, and investment-grade fundamentals are not mere coincidences; they are the dividends of prudent governance and visionary leadership.

While we are impressed by the marked progress in the evolving landscape of the Next Economy, we remain acutely aware of the monumental challenges ahead. The rate of change, especially in crucial sectors like energy and transport, is yet to meet the exigencies of our time, particularly the climate crisis. Nonetheless, the promising developments we have observed instill in us cautious optimism for a more sustainable, equitable, and resilient global economy.

As investors and stakeholders, we and our clients are both spectators and actors in this global transformation. The choices we make today delineate the contours of the future. In this context, the Green Alpha Next Economy Index doesn’t just serve as an investment tool; it stands as a manifesto for the world we envision and strive to create. With each recalibration, we come one step closer to aligning economic imperatives with planetary needs, fulfilling our collective fiduciary obligation to ourselves and to future generations.

Thank you for entrusting us with the responsibility of helping shepherd this critical journey. We invite you to join us as active participants in shaping a future where the economy doesn’t just survive, but thrives, in harmony with the world it inhabits.

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” “Investing for the Next Economy,” “Next Economics,” and “Next Economy Portfolio Theory.”

Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC. Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. This post does not constitute an offer to sell, or the solicitation of any offer to buy, any security. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/

Green Alpha portfolios may invest in companies with small and medium market capitalizations, which may have more limited product lines, markets, and financial resources than larger companies. In addition, their securities may trade less frequently and in more limited volume than those of larger companies. Small or mid-cap stocks may be more volatile than those of larger companies and, where trading volume is thin, the ability to dispose of such securities may be more limited. Green Alpha portfolios may also invest in foreign domiciled companies. Investing in foreign securities may involve additional risks, including exchange-rate fluctuations, limited liquidity, high levels of volatility, social and political instability, and reduced regulation. Emerging markets are often more volatile than developed markets and investing in emerging markets involves greater risks. International investing may not be suitable for everyone. An investment in Green Alpha portfolios should be considered a long-term investment.