IPCC report says “the extent and magnitude of climate change impacts are larger” than previously estimated.

Originally published by Bloomberg, February 28, 2022

Written by Natasha White & Saijel Kishan

A multitrillion finance movement intended to protect the planet and its people faces some awkward questions as fresh analysis from the world’s top climate scientists suggests it’s falling far short of the mark.

In a report published Monday, the United Nations’ Intergovernmental Panel on Climate Change provided a bleak picture, saying “the extent and magnitude of climate change impacts are larger than estimated in previous assessments.” The IPCC went on to say that “current global financial flows for adaptation, including from public and private finance sources, are insufficient.” It listed finance to developing countries as a particular weak point.

The findings lay bare the disconnect between the approach taken by governments, banks and parts of the environmental, social and governance investment community, and the existential threat that climate change represents. And while ESG investors, who collectively oversee about $2.7 trillion, are constantly acknowledging the extent of the problem, they’ve done little that’s discernible to help tame the pace of rising temperatures or help governments adapt to the changing climate.

“The IPCC is right,” said Garvin Jabusch, chief investment officer at Green Alpha Advisors, which oversees about $750 million from Louisville, Colorado, and [who individually] has been managing sustainable, fossil-free investments for two decades. “Overwhelmingly, the financial services industry hasn’t understood that the climate crisis is also an asset-management crisis.”

“The IPCC is right,” said Garvin Jabusch, chief investment officer at Green Alpha Advisors, which oversees about $750 million from Louisville, Colorado, and [who individually] has been managing sustainable, fossil-free investments for two decades. “Overwhelmingly, the financial services industry hasn’t understood that the climate crisis is also an asset-management crisis.”

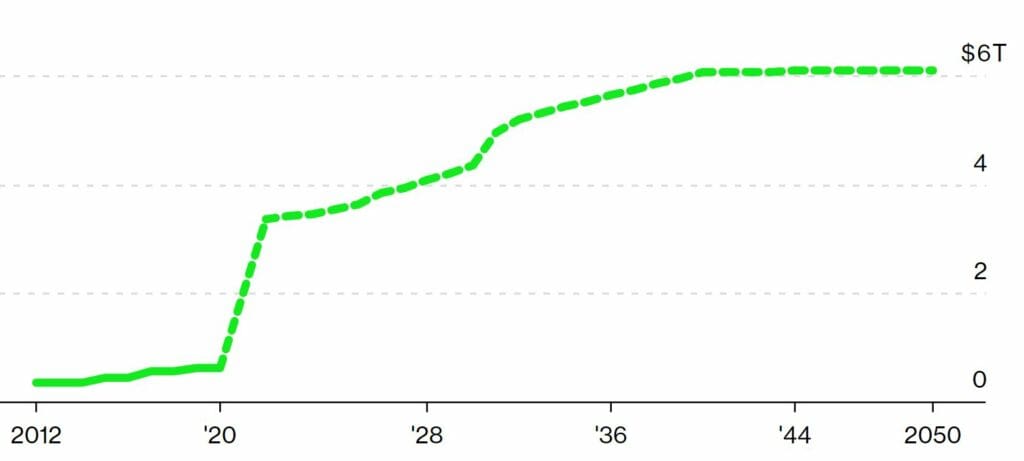

Falling Short

Global climate finance and future estimated needs for a 1.5 degree pathway

The Glasgow Financial Alliance for Net Zero, a group that includes many of the world’s largest banks, investment firms and insurers, estimates that about $125 trillion is required for the world to shift to a low-carbon future. BlackRock Inc. Vice Chairman Philipp Hildebrand said last year that failing to act may cost the world 25% of economic activity in the coming decades.

“It’s time for banks to get serious about stopping the financing of new fossil-fuel production,” said Jonas Kron, chief advocacy officer at Trillium Asset Management, one of the oldest ESG funds. Boston-based Trillium was among the investors that filed shareholder resolutions in December calling on Wall Street banks, including JPMorgan Chase & Co. and Bank of America Corp., to act faster on ending their role in financing climate change.

Dr. Nina Seega, research director at the University of Cambridge Institute for Sustainability Leadership, said the finance industry almost always focuses on short-term returns, a business model that isn’t suitable to address climate change.

“The time horizon is always a problem within financial services,” she said.

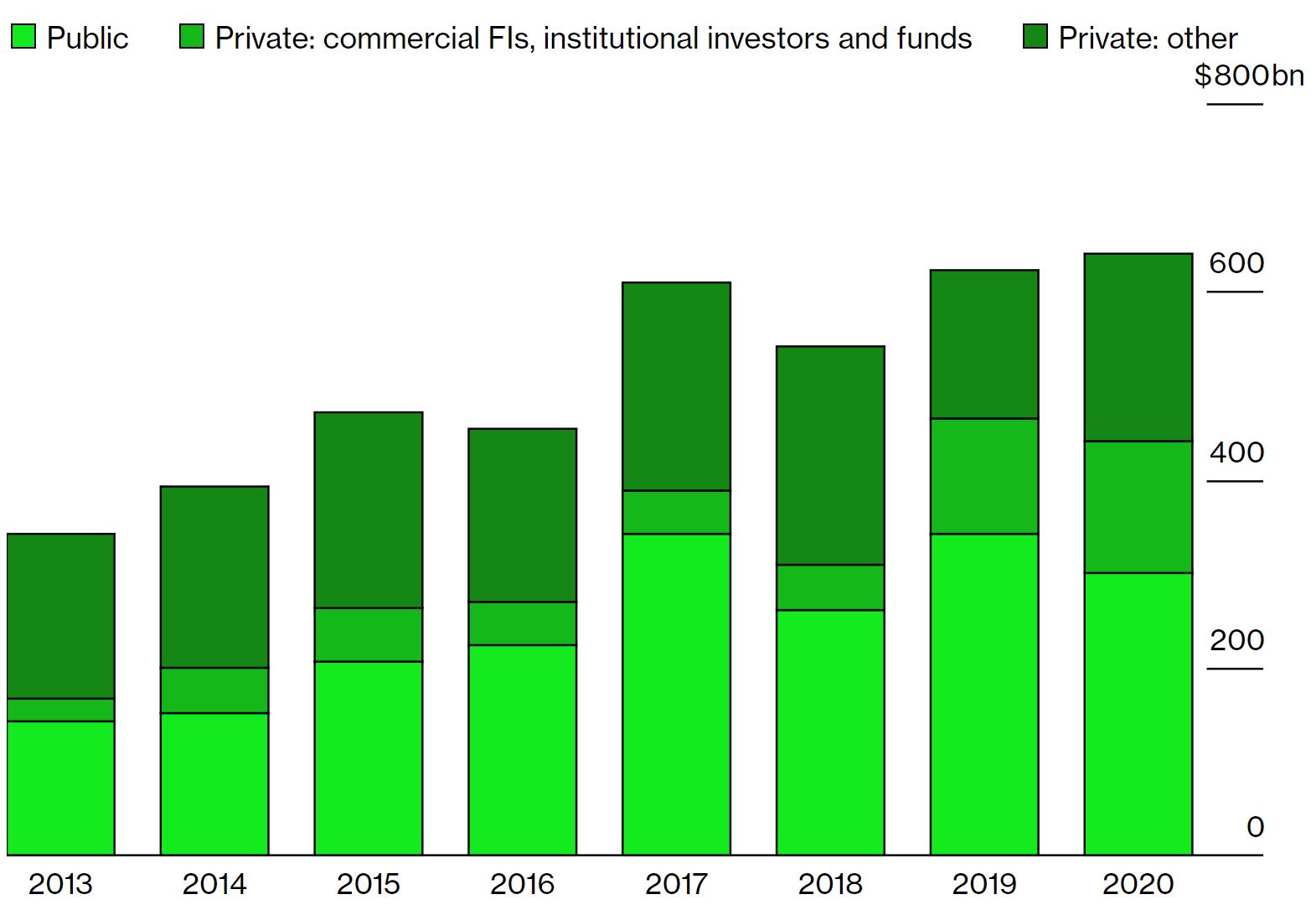

For example, financial firms and institutional funds provided just a fifth of the $632 billion that flowed annually to climate finance projects in 2019 and 2020, according to researchers at the Climate Policy Initiative. The bulk of financing comes from groups such as development finance institutions, which aren’t profits-focused.

‘Other’ private climate finance includes: corporations, households, and individuals

Global Climate Finance by Source

Commercial financial institutions, institutional investors and funds provided just a fifth of climate finance in 2020

“Overall, climate finance needs to grow at least threefold, and more likely sixfold, from current levels,” Lucian Peppelenbos, climate strategist at Dutch asset manager Robeco, wrote in a note Monday.

Meanwhile, some of the money being spent on climate appears to be going toward poorly conceived projects that pose new risks to the environment, livelihoods and the collective ability to adapt, the IPCC warned.

“Risks arise from some responses that are intended to reduce the risks of climate change,” it said. The panel cited the “adverse side effects” of some mitigation projects like afforestation of naturally unforested land and poorly implemented bioenergy.

Getting the financing wrong comes with enormous risks. The “global aggregate economic impacts” of climate change could be worse than previously assessed, the IPCC said. “Impacts and risks are becoming increasingly complex and more difficult to manage. Multiple climate hazards will occur simultaneously, and multiple climatic and non-climatic risks will interact, resulting in compounding overall risk and risks cascading across sectors and regions.”

Ludovic Subran, chief economist at Allianz SE, says the difficulty from an investment point of view lies partly in the challenge posed by making “decisions in a changing world with continued uncertainty about the severity and timing of climate change impacts and with limits on the effectiveness of adaptation.”

It’s not all doom-and-gloom, though, and the IPCC report offers a few strands of hope.

“Progress in adaptation planning and implementation has been observed across all sectors and regions” and “multiple climate resilient development pathways are still possible,” it said.

According to Franklin Steves, senior policy advisor on sustainable finance at E3G, the situation is now “better than it was three or four years ago.”

“Financial models are rapidly changing,” he said. “Once that ship starts to turn, it develops more and more momentum.”

— With assistance by Eric Roston

###

Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC. Registration as an investment advisor does not imply any certain level of skill or training. Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/