By Garvin Jabusch.

On Monday March 20th, the IPCC released its Synthesis Report of the comprehensive Sixth Assessment Report of the state of global warming. The IPCC Synthesis Report is the final installment of the Sixth Assessment Report, which is the most comprehensive assessment of the state of the climate ever produced. The findings are dire and global leaders’ reactions were swift.

In a video speech, U.N. Secretary General Antonio Guterres said, “The rate of temperature rise in the last half century is the highest in 2,000 years. Concentrations of carbon dioxide are at their highest in at least two million years. The climate time-bomb is ticking. But today’s IPCC report is a how-to guide to defuse the climate time-bomb. It is a survival guide for humanity…it will take a quantum leap in climate action.” Guterres challenged the G20 (rich nations) to speed up their goals of achieving carbon neutrality to 2040, from the 2050-2060 range many countries are now pledging, to give the world a chance to “defuse the climate time bomb.”

Guterres called the report a “code red for humanity” and said it “must sound a death knell for coal and fossil fuels, before they destroy our planet.”

U.S. Treasury Secretary Janet Yellen has warned that “As climate change intensifies, natural disasters and warming temperatures can lead to declines in asset values that could cascade through the financial system,” adding, “a delayed and disorderly transition to a net-zero economy can lead to shocks to the financial system.” She said, “These impacts are not hypothetical. They are already playing out.”.

Referring to the report, Scotland First Minister Nicola Sturgeon said, “the transition to net zero is not easy, far from it, but as well as being absolutely existentially necessary, it also offers us significant economic opportunities.”

No wonder some of the world’s most sober luminaries and policymakers are using uncharacteristically strong terms—the report’s findings were as clear as they were ominous:

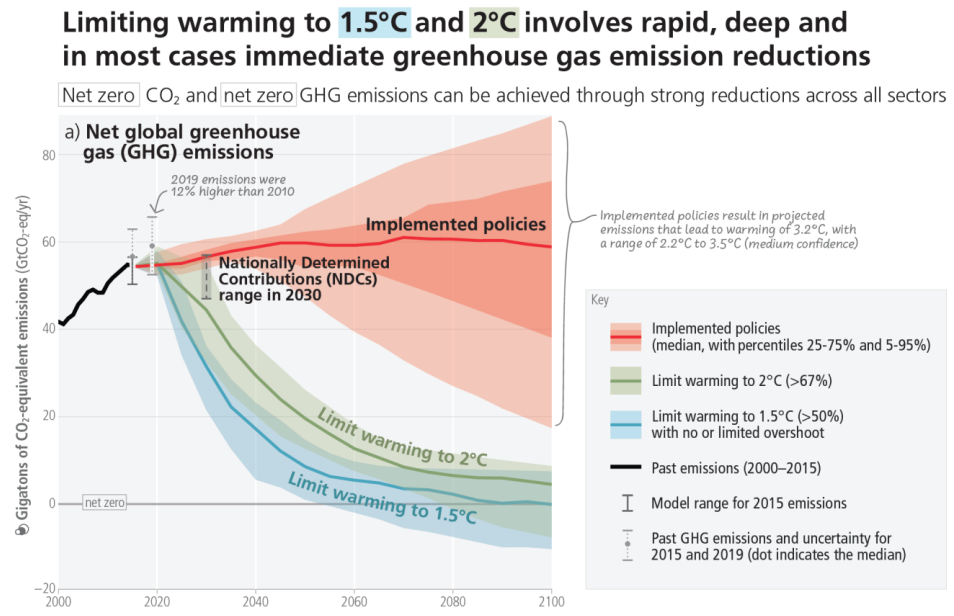

- Keeping the world at safe levels of warming, defined since the Paris CoP as 1.5°C, is not going to happen. There is no scenario that avoids exceeding the 1.5°C target and bringing temperatures back under that threshold will require extracting billions of tons of CO2 from the atmosphere.

- Global emissions have not fallen but have continued to rise since the 1.5-degree target was established at the 2015 Paris Climate Accords, indeed hitting an all-time high in 2022.

- If all fossil fuel infrastructure currently planned around the world is developed, there is an 83 percent likelihood of reaching irreversible levels of warming, defined as 2°C or more.

- To avoid this, greenhouse gas emissions must be slashed to 40% of 2019 levels by 2035, a 60% reduction in 12 years.

- Getting the global economy to “net zero” (meaning the summation of human activities removing as much GHG pollution as it emits) requires “a substantial reduction in overall fossil fuel use.”

- For the first time, IPCC dedicated a section of the Synthesis Report to the need for urgency, writing, “The choices and actions implemented in this decade will have impacts now and for thousands of years.”

In short, the report makes it clear that a rapid phase-out of all fossil fuels is necessary to avoid irreversible harm.

And yet, business-as-usual trundles on. Equity markets didn’t seem to notice the news, and in fact, many renewable energy holdings and other climate related stocks were down for the day.

The week before the Summary Report was released, the U.S. approved a new oil drilling project in Alaska, the largest proposed oil project on U.S. public land. Many prominent ESG-branded funds continue blithely to hold fossil fuels and other major GHG emitters, as though these things are safe, and supporting their share prices with continual buying doesn’t send the signal that they are good investments that can and should endure indefinitely. These are to climate what Secretary Yellen might call “delayed and disorderly.”

We’ve said it in our methodology documents, in previous posts, and we’ll say it again: there exists an objectively right way and an objectively wrong way to invest for climate impact. ESG funds that hold fossil fuels companies that are “more sustainable” than their fossil peers, or responsible ETFs that indicate they hold oil majors so they can vote their proxies or nominate directors, are engaging in the kind of incrementalism and foot dragging that Guterres was warning us about.

Hoesung Lee, chair of the IPCC, went out of his way to release a post highlighting the role of finance and investment management in the process of stabilizing the world. He said the shift to a safe economy is currently hampered by financial flows which “are a factor of three to six times lower than levels needed by 2030 to limit warming to below 2°C.” He’s right, the investment community is and has been far too slow to finance the transition to sustainability.

The effects of our actions must be compatible with what we need the economy to be, and the power of capital flows is so great that it literally defines the future. In response, we at Green Alpha in 2008 developed a set of principles that guide the investment choices we make, because the investments we collectively make will define our destiny.

There is a common but wrong trope that goes something like ‘investments in sustainable companies underperform.’ On the contrary though, our last decade of results shows that, in fact, it is remaining invested in the dangerous legacy economy that leads to relative underperformance. Since inception (March 31, 2013) through February 28, 2023, Green Alpha’s Next Economy Select strategy in which we manage the NXTE ETF has returned an average annual 15.2%. Over the same period, the S&P 500’s average annual return was 11.9%.

The other objection to maximizing portfolio impact we often hear is the world just needs more time to make the transition to a lower risk economy. But we don’t need more time, we have everything we need, except a sense of urgency in the investment management community. What we do need is to change the direction of velocity of investments so that we don’t spend time that we do not have.

So why did the market shrug off the IPCC report? Most likely some combination of status quo bias, the narrative setting power of entrenched and powerful industries, and the desire to turn instant gains. The proclivity of markets to focus narrowly on tomorrow, next week, or at best, next quarter, means that even something as drastic and impactful as a 60%, global GHG emissions cut in just the next 12 years isn’t on the radar for most traders and their algorithms. This short-termism is in fact a market inefficiency that presents large, even generational, opportunities for the more patient investor, in a function we have come to refer to as Chrono-arbitrage.

Taking an absolutist approach to climate investing will ruffle the feathers of mainstream asset management, no question. But the rhetorical must be asked, are we better served by dropping a bomb on legacy investing methods, or by allowing the climate bomb to detonate on our economy? Because one of those things is most definitely happening.

Finally, here’s an image posted by SpaceX this week, coincidentally on IPCC’s report release day. It’s worth remembering, humanity is all alone out here in the black; we have to save ourselves.

###

Performance quoted throughout this article represent past performance. Past performance does not guarantee future results, and current performance may be lower or higher than the data quoted. Investment returns and principal will fluctuate with market and economic conditions, and investors may have a gain or loss when shares are sold. To see and evaluate more complete performance results than is present here, please see each portfolio snapshot document, which are posted here: https://greenalphaadvisors.com/investment-portfolios/

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/