By Garvin Jabusch, CIO.

In the field of investment management, one of the key performance metrics we’re judged against is our ability to generate portfolio returns comparable to those of a benchmark index; think S&P 500 Index or Dow Jones Industrial Average. If portfolio returns deviate from the benchmark too much, those returns can be labeled “volatile,” or “risky.” It is generally accepted that a portfolio exhibiting returns with greater volatility than an index is riskier, and therefore less desirable. Yet, few investors stop to ask: what is a benchmark, and what does it truly represent? Principally, an index (and all benchmarks are indices) is the embodiment of the current economy. This being the same current economy that has given rise to the climate crisis, acute social inequality, badly damaged natural resources, and a terrible human disease burden.

For asset managers like Green Alpha, whose focus is investing in and for a sustainable and regenerative economy, correlating with or mimicking the returns of that legacy is not appealing. Tracking and reflecting a sustainable economy that, although emerging, does not yet exist, means not prioritizing correlation with the benchmarks. Rather, it means investing in the companies already running sustainably and in the process of actively building the Next EconomyTM.

Even so, we are often asked if that puts us at risk of delivering less competitive, “riskier” returns.

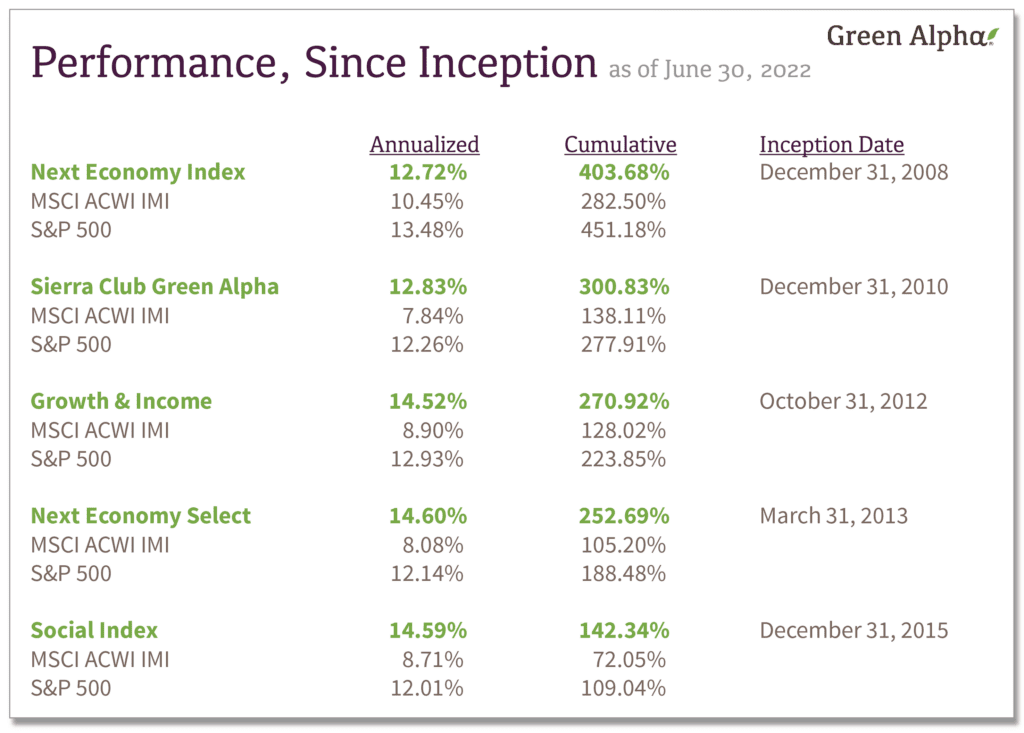

The answer is no. As you can see in the table, each of our core investment strategies since inception has earned meaningful outperformance versus frequently cited market benchmarking indices. Green Alpha’s own stated reference benchmark, the MSCI All Country World Investible Market Index (MSCI ACWI IMI), is no exception to that. In addition, four of our five core strategies have outperformed the S&P 500 since their inception dates.

Of the mainstream benchmarks, we view the MSCI ACWI IMI as the most appropriate for our strategies, since both the MSCI ACWI IMI and our portfolios are all-cap, cross-sector, cross-industry, and global. Still, the MSCI ACWI IMI is not exactly comparable. Why? Because what we are attempting to build is the transition to the next, indefinitely sustainable economy. To truly benchmark our strategies, that economy would have to exist and be progressing in a measurable way. Since this is not yet the case, we are required, although skeptical about it, to reference ourselves against the current indices. To date, we have been earning alpha—excess returns—against the present economy, primarily because the next economy is advancing faster than the incumbency, or if you like, faster than underlying GDP.

At present, we are living through the largest economic transition in history—toward electrification, decarbonization, and dematerialization. Every day, in some way, the next economy is inching incrementally closer to becoming the predominant economy. In that sense, one could say the big indexes are becoming more relevant benchmarks for Green Alpha as each year passes. We look forward to the time our strategies stop exhibiting tracking error (volatility relative to a benchmark), because that will indicate the world has reached a point of true sustainability. Perhaps then we will change our name to Green Beta Investing (beta referring to index returns). We would welcome that day; ceasing to earn excess returns owning leaders in a completed transition is a small price to pay for a world that has learned to thrive indefinitely.

Unfortunately, the world is still in the very early stages of the energy and sustainability transitions. The present-day destructive enterprises of the legacy economy are still formidable and will not fade into obscurity anytime soon. This reality is visible in the numbers, as, for example, the IPCC warned in April, the world is investing perhaps a tenth as much capital as is needed to meet the Paris climate goals. This demonstrates the importance of capital investment direction and velocity over diplomacy. Paper commitments are all well and good, but the future production function of the global economy follows today’s investments, not today’s pledges.

If the ability to earn alpha remains tethered to the speed—fast or slow—of the transition to a sustainable economy, our opportunities to seek competitive returns will remain promising for some years to come.

###

Past performance isn’t a guarantee of future results. Please see important performance disclosures here, and additional disclosures here. Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Advisors also owns the trademarks to “Next Economy,” “Next Economics,” “Next Economy Portfolio Theory,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC. Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice.