Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

At Green Alpha, we realize that our business of asset management is just one portion of overall wealth management. Asset management largely entails securities selection, portfolio construction and risk management. Wealth management, on the other hand, means providing expertise in all aspects of financial life, such as tax planning, real estate planning and investment advice. Managing a client’s wealth also includes determining appropriate portfolio allocations for clients and selecting managers for portions of an overall allocation. This is where an asset manager like Green Alpha can enter the picture.

In the best scenarios, asset managers and wealth managers are complementary, providing powerful synergies for clients. For us, that means partnering with other experts in the field. BSW Wealth Partners provides holistic financial planning and wealth advice for their clients, and they allocate some investment portfolios to Green Alpha, to provide clients the best that each have to offer.

We recently sat down with Julie Martinez and Craig Seidler to catch up on the evolution of both of our firms, growth in our respective businesses, the transformation of sustainable investing, and why enjoy working together so much. Here are highlights from that discussion:

Betsy: The BSW Wealth Partners manifesto is “Make Life Better.” Tell us what that means to you and your colleagues.

Julie: My colleagues and I are a diverse group, but we share one ethos, one fundamental reason for being in this business: we see this as a helping profession and our standards are high in this regard. We want to create real impact in client’s lives. Internally, we also know that Make Life Better pertains to each other as a work family. Both BSW clients and our fellow teammates motivate us every day to get better, to be better. It’s truly a purpose-driven environment.

Betsy: Your introductory video features a famous talk by Alan Watts, British philosopher and Zen Buddhist. Why start there with clients and prospective clients?

Julie: In our work with clients we know that there is not a magic level of wealth that will allow them to live their best life. Although our clients hold significant financial capital, they also hold tremendous amounts of human capital, intellectual capital, social capital — even health is a capital that has value. We see our clients from this broader perspective, rather than from a one-dimensional perspective.

Betsy: With more than two decades of experience in sustainable and impact investing, you were pioneers in this field of investing. What is sustainable and impact investing, and why do you believe it has grown so rapidly in recent years?

Julie: We view values-based investment strategies as the evolution of both investing and philanthropy. Impact investing is simply integrating social and environmental factors into investment decisions. We began our work in sustainable and impact investing decades ago to better support client intentions. When a client devotes time and effort engaging in climate change issues, for example, or is giving to related causes, it just didn’t make any sense for the client to have a portfolio misaligned with those values. That has been our inspiration. Now, our capabilities span all major asset classes, enabling investors to grow their capital and make the world better. Purpose-driven women and millennials who see investing as an opportunity to articulate their values are among the biggest contributors to the growth in this space.

Betsy: Where do see sustainable and impact investing evolving to in the next five years?

Craig: Over the next five years BSW sees impact and sustainable investing becoming even more mainstream. As data on everything from a company’s carbon footprint to their community outreach becomes more available and searchable, these factors will be just as important as P/E ratios or balance sheet health in considering potential investments. We also see social media playing a big part. Instant public feedback on corporate actions, both positive and negative, will be change agents for good. Lastly, as artificial intelligence becomes more prevalent, we see it helping in determining the most sustainable business choices. Since the many ripple effects of business decisions start to get exponentially complex, AI programs can be employed to crunch likely outcomes.

Betsy: At Green Alpha, we believe companies creating solutions to climate change, resource degradation and widening inequality are important drivers of wealth creation in the current and future economy. Do you share that point of view?

Craig: Absolutely. Resources; no matter if they are natural resources, human capital or time itself, are limited. Businesses that operate as if this is not the case are getting left behind. Not only because their costs will be going up over the medium-term, but because they do not control their own destinies – they will be cost takers, not cost makers.

On the other hand, firms that are addressing these meta-challenges will create the most significant wealth for their stakeholders in the near future and will be the ones providing products and services to the slower-to-pivot “old school” firms! We also believe wealth creation in the future will be more comprehensive than just returns on company stock – it will include a firms’ philanthropic, outreach and community development efforts as well.

Betsy: In which sectors of the economy—for example renewable energy, water or agriculture/food—do you believe investors can make the biggest impact when it comes to public equity investing?

Craig: Within the public equity realm, BSW thinks investors can make the most impact in the renewable energy sector. We think of it this way — equity is just another form of financing for firms. In the case of renewable energy, firms need lots of capital to build out manufacturing facilities, buy materials and create scale. Yes, they can tap the debt markets, but only to a certain level. By issuing equity, these firms can remain more nimble (fewer cash needs for interest payments) and more importantly, can use their stock as currency for future mergers and acquisitions. M&A will be important going forward to gain scale and lower costs.

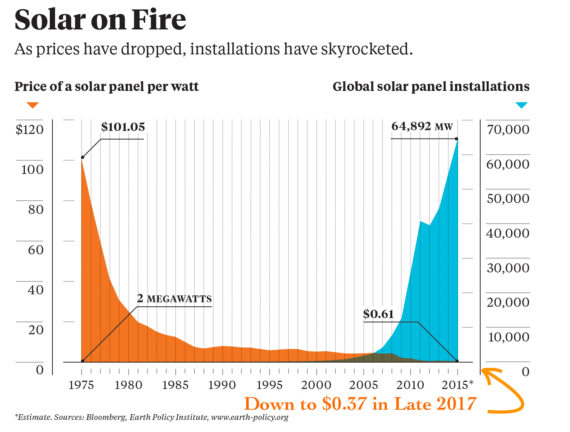

The writing is already on the wall in energy – investors ignore it at their peril. Long live the solar cost curve!

Betsy: BSW Wealth Partners was recently named a Top 50 Best Places to Work for Financial Advisers by InvestmentNews. It’s one of several workplace awards BSW has won, including from Outside Magazine. What’s brought you success here?

Julie: These accolades recognize all we do to invest in our people, culture and work environment. We work hard to create a culture that motivates, attracts and develops talent. In turn, our employees work hard to make our clients lives better because we are building something bigger than ourselves. While we are honored by the accolades, we have so much more work we want to do in this area. The financial advisory industry lacks diversity. Only 16% of financial advisors are women, and minority representation is even lower. The Institute for Women’s Policy Research recently reported that financial advisors have the largest gender pay gap of any profession. We want to be on the leading edge of change in this area. Any race, gender, social class, and sexual orientation will always be welcome at BSW Wealth Partners. We are here to build and foster a community of respect, love and mutual support. We are a certified B Corporation, which involves rigorous third-party verification that challenges us to meet the highest standards of accountability, transparency, and social and environmental performance. We are working every day to be the change we want to see in our industry. This is what makes me excited to get to work every day.

Important Disclosures https://greenalphaadvisors.com/about-us/legal-disclaimers/