By Garvin Jabusch, CIO.

The world is facing a critical juncture in its history, where the survival of humanity and countless other species is at stake. The climate crisis and the destruction of biodiversity threaten to destabilize ecosystems, disrupt food supplies, and displace millions of people. To address these challenges, we need a radical transformation of the global economy, one that prioritizes regenerative practices over extractive and destructive ones.

What would it look like if investors treated the climate crisis like the emergency it is? With researchers concluding that limiting warming to 2°C is a stretch goal nations are not likely to meet, what will it take to keep global heating to the lowest still-achievable level?

The Single Most Important Intervention

So far, no government has been willing to take the single most important step to stop climate breakdown: capping fossil fuel use and scaling it down on a binding, aggressive schedule. This is one of civilization’s key failings to date, as ending fossil fuels is the only fail-safe way to prevent catastrophic consequences.

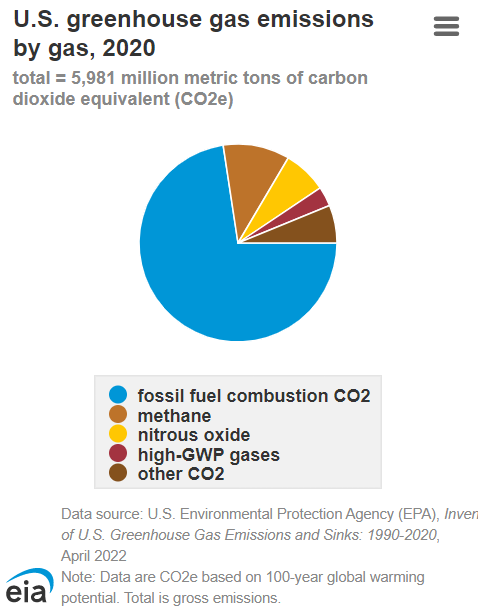

Fossil fuels account for three quarters of greenhouse gas emissions, and so, for the world to remain livable, they have to go. A recent campaign, endorsed by 100 Nobel laureates and several thousand scientists, calls for a Fossil Fuel Non-Proliferation Treaty to do just that: an international agreement to end fossil fuels. And yet we must ask, is such an agreement likely any time soon? Soon enough to prevent catastrophe? Given that 2022 was humanity’s record-setting (so far) year for GHG emissions (despite 27 United Nations Climate Change Conference of the Parties having come and gone), experience says no.

Ending fossil fuels will require a fundamental change to the economy, and, in the absence of a binding Fossil Fuel Non-Proliferation Treaty, there is only one lever left to pull: shift capital flows. The economy of tomorrow emerges directly from today’s investments, so the clearest path to a livable world is to redirect capital away from the causes of catastrophe and towards the fixes.

That’s it, that’s our path.

We have the technology and the resources to do it. This will not be easy, but it is possible. All we need is to change the mindset of asset managers away from the perception that the legacy fossil economy represents safety for investors, and towards building portfolios to prioritize managing the economic risks that matter most.

Actualizing the Intervention

Asset management, which controls many trillions of dollars, has the crucial role to play in this transformation. By directing capital towards companies that prioritize sustainability and regenerative practices, asset managers can incentivize, and even create, the transition to a more sustainable economy. On the other hand, by continuing to invest in companies that prioritize short-term profits over long-term sustainability, asset managers are complicit in perpetuating the status quo: the road to collapse. To make this transition, we need to mobilize capital on a scale never before seen, and we need to do it quickly.

One of the most significant hurdles to tackling the climate crisis is the resistance from vested interests. The fossil fuel industry has consistently misled the public about the climate crisis and lobbied against regulations that would limit its activities or compel it to transition to cleaner energy sources. Similarly, industries that rely on planned obsolescence or unsustainable practices resist changes that could affect their profits. This resistance is not surprising; the industries that benefit from the status quo have amassed significant wealth and power, and they are reluctant to relinquish it. However, as we face a climate crisis that threatens the planet’s habitability, we must challenge these entrenched interests and demand the changes that are necessary for survival. The best way to challenge them is to stop supporting their share prices and market capitalizations with continual investment flows.

Yes, that means wholesale divesting from fossil fuels: Perhaps the most impactful action asset managers can take to reverse global warming is to divest from fossil fuel companies. By withdrawing investment from companies that extract, transport, or process fossil fuels, asset managers can send a clear market signal that the industry is no longer viable in a livable future.

Despite the challenges, the transition to a sustainable economy offers enormous opportunities. For example, investing in clean energy and sustainable agriculture is creating millions of new jobs, many of which are well-paying and require advanced skills. The shift towards a circular economy, where waste is minimized and materials are reused, will continue to spur innovation and create new markets. Moreover, transitioning away from fossil fuels will reduce the economic and political power of nations that rely on them and reduce the likelihood of conflicts over access to resources.

Transforming asset management to prioritize regenerative companies is not only a matter of survival but also a matter of financial prudence and moral responsibility. Asset managers have a crucial role to play in incentivizing the transition to a more sustainable economy, and by doing so, they can help to build a better world for everyone and earn competitive returns for clients in the process.

Do we at Green Alpha therefore subscribe to the idea of de-growth as the only way to prevent climate chaos? No. But we do perceive the need to scale down the destructive parts of the economy: fossil fuels, ICE vehicles, fast fashion, planned obsolescence, and so on. We need to focus the economy on what is required for human well-being and ecological stability. Industries focused on electrification, zero-emissions power, greater productivity, and zero petrochemicals must grow very rapidly. In aggregate, this will result in net economic expansion–growth–even as destructive industries shrink.

Redirecting capital flows is how we stop climate breakdown. But it won’t happen on its own. Asking politely for the incumbent industries to act, and act fast, is not going to cut it. Change will require an extraordinary struggle against those who benefit so prodigiously from the status quo. It requires forging alliances between business and investment management, and across borders, sufficient to pull off coordinated redirection of capital. This decade is the linchpin of history. We cannot afford to just sit back and wait to see what happens.

###

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/