Deprecated: Creation of dynamic property SocialSharing_Shares_Controller::$models is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/vendor/Rsc/Mvc/Controller.php on line 28

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

By Garvin Jabusch, CIO

The world is being forced to realize that without addressing our systemic risks, we are in some pretty serious trouble, and that the economy will be just one of the casualties. As our clients and partners know, we at Green Alpha believe that if we invest to solve those risks, we can create jobs, wealth, better opportunities for equality, and of course…great returns for investors. It’s good that many investors are coming around, too slowly, sure, but still, it’s the right direction.

The Implications of Climate Change for Financial Stability

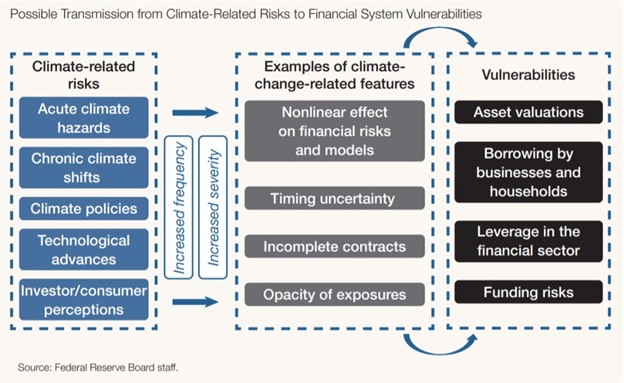

The latest encouraging development comes from the Federal Reserve in its November Financial Stability Report. Somewhere near the back, after the usual banalities like the LIBOR Transition Update, they include a section titled “The Implications of Climate Change for Financial Stability,” and even add a handy graphic:

It’s interesting here to see that they recognize the increased frequency and magnitude of both climate hazards and tech advances as drivers of nonlinear effects on financial models. Meaning, the world is changing fast on several levels simultaneously, and our traditional models of how to run economies and investments are starting to crack. The Fed understands that it is a new world of risk and innovation, and any policy or investment decision from now on needs to try hard to assimilate these changes in context before proceeding.

The best time for the Fed to have made this recognition was decades ago, but as the old saying goes, the second best time is now. As the bank points out, “the poorly understood relationships between [climate] events and economic outcomes, could lead to abrupt repricing of assets.”

Climate-Related Solutions Have Value

Asset allocators take note: what the Fed is effectively saying here, is that fixes to climate risks will have value, causes of these risks won’t. Repricing moves both ways. In Green Alpha’s view, this addition to the Stability Report is welcome but overdue. The central bank acknowledges, “Climate change adds a layer of economic uncertainty and risk that we have only begun to incorporate into our analysis of financial stability.” But it is a beginning. For us, it is a breakthrough toward broader acceptance of our belief that it’s time to let go of old fashioned definitions of risk, like price volatility and index correlation, and instead manage our investments in terms of changes that matter in the real world.

###

Nothing in this blog post should be construed to be individualized investment advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/