By Garvin Jabusch.

Recent reports from major financial institutions like Morgan Stanley and JPMorgan Chase have made a startling admission: they now expect a world that will warm by 3°C above pre-industrial levels. This projection obviously blows past the internationally agreed Paris targets and signals an alarming shift in how Wall Street is positioning itself for the future.

One could view the big banks’ new forecasts as simply reflecting reality. As Bloomberg recently reported, scientists have concluded that it’s somewhere between “likely” and “virtually certain” we’re in the midst of a 20-year period where the Earth has breached 1.5°C, and the United Nations has warned humanity is on course for twice that much warming on our current path—considered to be a catastrophic outcome for billions of people. So again, the asset management industry’s new projection cloud be seen as rational acceptance of reality, sure, but even more troubling is the cognitive dissonance on display—these same institutions continue to finance and invest in fossil fuel expansion while acknowledging the catastrophic consequences of such a temperature increase.

As an asset manager focused on innovation, economic productivity, and mitigating systemic risks like the climate crisis, I find this contradiction fundamentally flawed as an investment thesis. It represents a profound failure of our industry’s core purpose, which of course is to grow future purchasing power while mitigating risks, and it also ignores the inevitable reckoning that awaits.

The Failure of Fiduciary Duty

For Aniket Shah, head of sustainability and transition strategy at Jefferies Financial Group Inc., this reality raises awkward questions for the financial sector: “The world isn’t on a path for net zero by 2050 and so any bank or asset manager that’s being told to align lending or investment practices to that kind of pathway is aligning with a fictitious world,” he said.

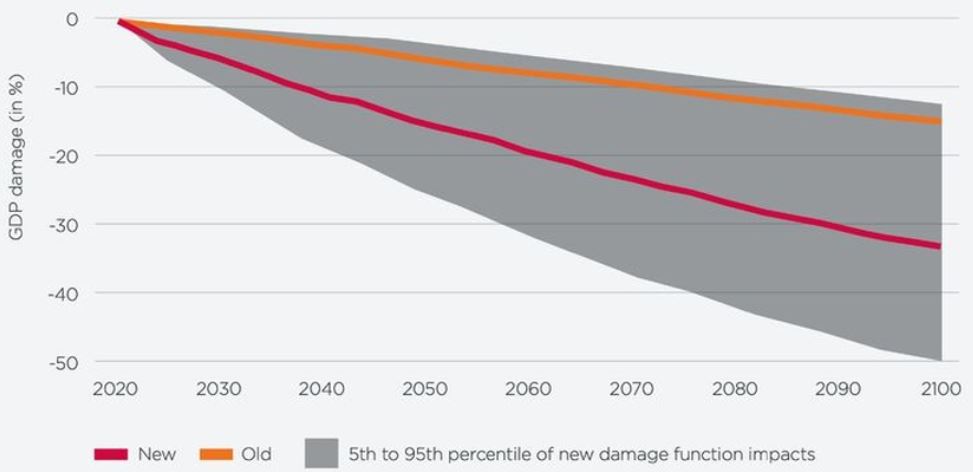

This statement exposes a fundamental tension but draws the wrong conclusion. The flaw in Shah’s framing is that if asset managers did align investments with a net zero 2050 world, then that world would no longer seem “fictitious.” If we, the asset management industry, deliver to the world over the next decade a planet that is increasingly warmer and on the way to 3°C, with severely degraded resources and worsening inequality—all of which will devastatingly impact economies and political stability—then we have categorically failed as financiers and capital allocators.

Our industry exists to identify value, manage risk, and allocate capital efficiently to build sustainable wealth. How can we claim to be fulfilling this function while knowingly financing activities that will destroy trillions in economic value? The contradiction exposes a fundamental misunderstanding of what constitutes prudent investment in the 21st century.

As Rhian-Mari Thomas, a former Barclays banker who now runs the Green Finance Institute, argues, “The need for financial institutions to meet their fiduciary duties is often cited as a reason not to pursue opportunities that are aligned with net-zero pathways. Surely another consideration, based on science, is to ensure market integrity: Deals that may seem rational in the short term could ultimately threaten the resilience of the markets.” This gets to the heart of the matter—true fiduciary duty requires looking beyond quarterly earnings to market resilience and long-term value creation and preservation. And yes, you read that first part right: fiduciary duty is being used today as a reason NOT to mitigate risk. This is clearly absurd.

A 3°C warmer world isn’t just an environmental concern—it’s a world of profound economic instability. It means:

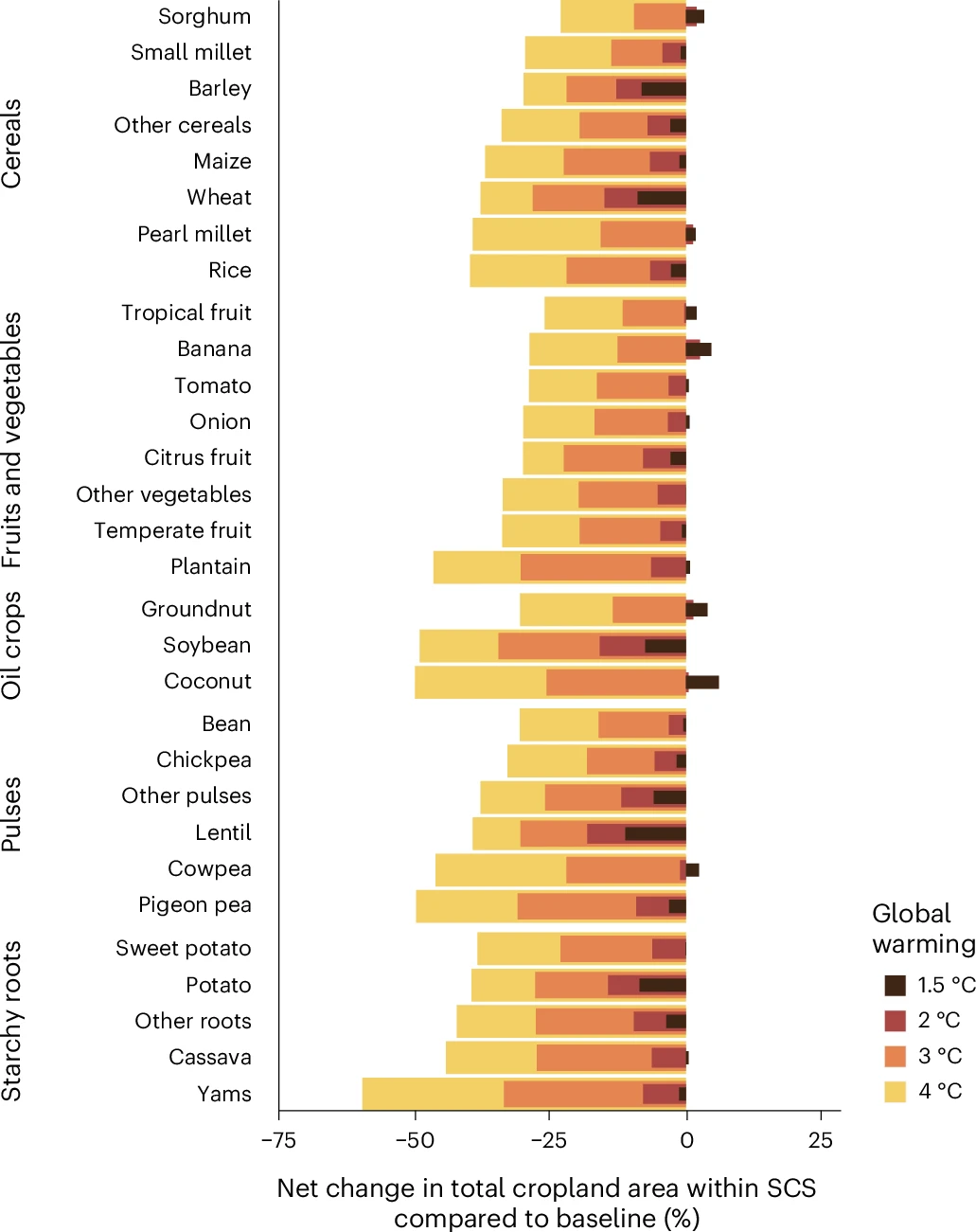

- Agricultural systems under extreme stress, threatening food security.

- Coastal real estate markets collapsing under rising seas

- Many parts of the world, including much of its most valuable real estate, are becoming uninsurable. Günther Thallinger of Allianz SE—one of the world’s largest insurance firms—has recently warned on LinkedIn that if global warming isn’t kept close to 1.5°C, so much capital could become uninsurable that entire sectors of the global economy may collapse.

- Specifically, Thallinger wrote: “approaching temperature levels—1.5°C, 2°C, 3°C—where insurers will no longer be able to offer coverage for many of these risks. The math breaks down: the premiums required exceed what people or companies can pay. This is already happening. Entire regions are becoming uninsurable. (See: State Farm and Allstate exiting California’s home insurance market due to wildfire risk, 2023).

This is not a one-off market adjustment. This is a systemic risk that threatens the very foundation of the financial sector. If insurance is no longer available, other financial services become unavailable too. A house that cannot be insured cannot be mortgaged. No bank will issue loans for uninsurable property. Credit markets freeze. This is a climate-induced credit crunch.“

- Specifically, Thallinger wrote: “approaching temperature levels—1.5°C, 2°C, 3°C—where insurers will no longer be able to offer coverage for many of these risks. The math breaks down: the premiums required exceed what people or companies can pay. This is already happening. Entire regions are becoming uninsurable. (See: State Farm and Allstate exiting California’s home insurance market due to wildfire risk, 2023).

- Infrastructure failures under extreme weather events

- Mass migration and geopolitical instability

- Incalculable health costs from heat stress and disease spread

- Water scarcity as an economic multiplier: Water stress will become a primary economic constraint affecting everything from semiconductor manufacturing (which requires enormous quantities of ultrapure water) to hydroelectric power generation. The World Bank estimates water scarcity could reduce GDP by 6% in some regions by 2050, creating investment risks that most portfolio models currently ignore.

- Climate-driven market volatility: Weather extremes are already driving unprecedented commodity price volatility. Agricultural futures markets are showing historically anomalous patterns as crop yield predictability decreases, making food processing companies and retailers particularly vulnerable to earnings shocks.

These aren’t externalities that can be separated from investment returns—they are material financial risks that will devastate portfolios, regardless of how many air conditioning companies one invests in as a hedge. These factors compound and interact with one another, creating systemic risks that traditional diversification strategies (generally, mimicking the sectors in an index) cannot adequately address. These aren’t externalities that can be separated from investment returns—they are material financial risks that will devastate portfolios, regardless of how many air conditioning companies one invests in as a hedge.

The Inevitable Backlash

History teaches us that the pendulum never stops swinging. Social and political backlash is inevitable when powerful institutions act with such disregard for the common good. At some point, investors, customers, regulators, and society at large will hold our industry accountable.

They will rightly say: “You knew. You knew that the climate crisis and associated risks were relevant, and you chose not to do much about it. Even when you knew investing to mitigate those risks would drive the success of the economy, you didn’t do anything about it. You had the data, the projections, the technological alternatives, and the capital to drive change. Yet you chose the 19th century energy technology of burning stuff over long-term prosperity. You failed in your most basic duty—to allocate capital wisely for sustainable returns.”

Examples from history are numerous. Industries that failed to self-regulate or address obvious harms—from tobacco to asbestos to predatory lending—eventually faced crushing litigation, regulation, and public abandonment. The financial industry’s stance on climate is heading toward a similar reckoning, but at a far greater scale.

The Competitive Advantage of Foresight

The current positioning of major financial institutions is strategically myopic. As banks work to normalize a 3°C world, they’re missing the enormous opportunity to lead the transition to a cleaner economy.

The prevailing market logic creates a paralyzing situation. As Nigel Topping, the former United Nations climate champion for COP26, notes, banks focused on decarbonization face immediate penalties. Currently, any bank CEO who says “I’m going to exit the fossil-fuel sector would be sacked the next day” because the company would be giving up too much earnings potential. This creates a collective action problem where short-term profit incentives trap the industry in a race to the bottom.

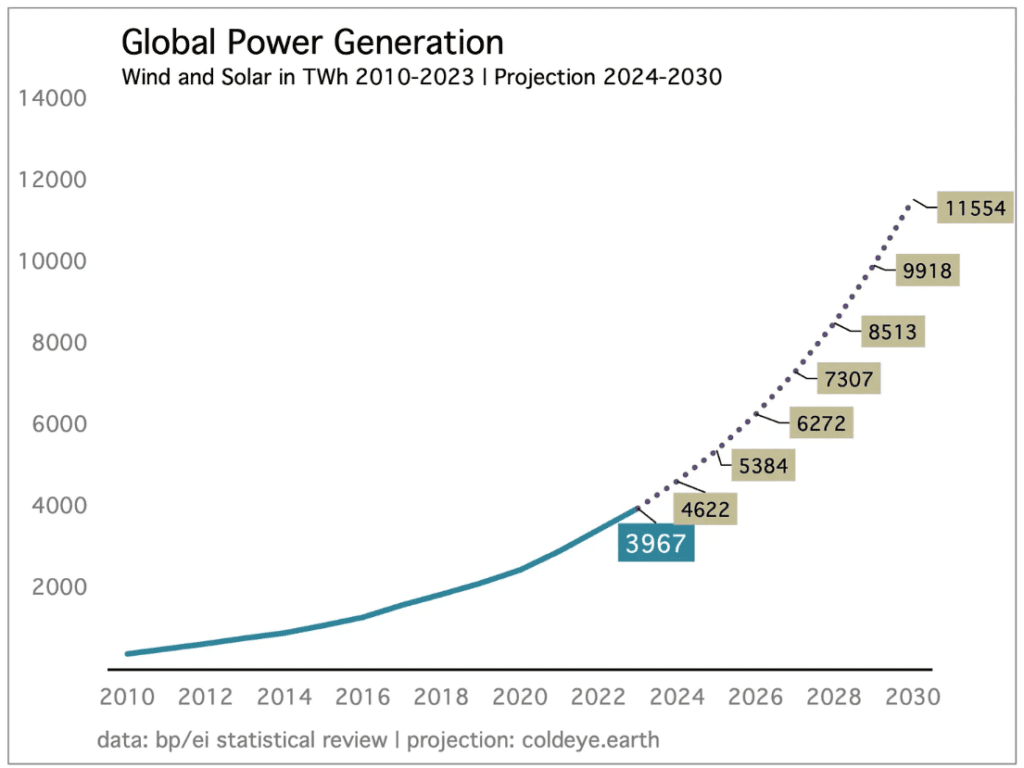

The global transition to net-zero represents the largest reallocation of capital in human history—estimated at $125 trillion through 2050. Those who authentically position themselves to facilitate this transition will be capturing the greatest growth opportunity of our era.

Meanwhile, those continuing to finance fossil fuel expansion face mounting transition risks:

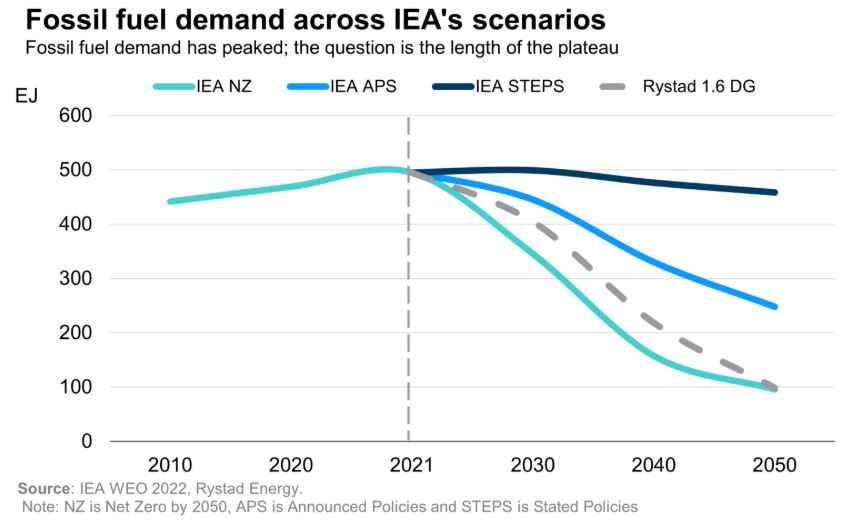

- Stranded assets as regulations tighten

- Reputation damage as public concern grows

- Litigation risk from climate impacts

- Client flight as awareness increases

- Talent exodus as younger professionals demand purpose alongside profit

- Social backlash as the world degrades

The Path Forward: Authentic Climate Strategy

This moment calls for the asset management industry to embrace an authentic, no-nonsense climate strategy. This isn’t about virtue signaling or greenwashing. It’s about recognizing the material financial risks of climate change and the transformative investment opportunities of addressing it.

Innovation and Productivity: The True Engines of Wealth Creation

Throughout economic history, innovation and productivity gains have always been the greatest sources of wealth generation. From the steam engine to the microchip, transformative technologies that improve efficiency and create new capabilities have driven prosperity and investment returns.

Today’s climate-mitigating technologies represent exactly this kind of wealth-creating innovation. Solar energy has seen efficiency improvements and cost declines that have outpaced even the most optimistic projections from a decade ago. Electric vehicles are demonstrating superior performance, lower maintenance costs, and rapidly declining battery prices. Grid-scale storage, and advanced materials are all following similar innovation curves. At Green Alpha we additionally argue that AI, automation and robotics, along with the biotech revolution, represent such large and exponentially growing economic productivity gains that they are also essential parts of a growing economy of abundance that can exist indefinitely within the planetary boundaries, and thus greatly mitigate systemic risk.

In stark contrast, fossil fuels represent inefficient, legacy technologies from the 19th century that have reached plateaus in their development. Their fundamental thermodynamic limitations, diminishing returns on exploration, and mounting externalized costs make them poor candidates for driving future productivity gains. Why would an industry focused on value creation tie its future to a technology with such limited growth potential?

The most forward-thinking asset managers recognize this reality: the clean energy transition isn’t just about mitigating climate risk—it’s about positioning portfolios to capture the next great wave of innovation-driven returns. When we invest in climate solutions, we’re not sacrificing returns for ethics; we’re recognizing where the greatest productivity gains and therefore wealth creation opportunities of the 21st century lie.

An authentic climate strategy means:

- Honest assessment: Acknowledging the catastrophic implications of 3°C warming and refusing to normalize it as an acceptable outcome

- Science-based targets: Aligning investment portfolios with a 1.5°C pathway, not because it’s easy, but because it’s necessary for long-term economic stability. Yes, the world seems to have already exceeded 1.5°C, yet we should still focus on this number as something to return to, since avoiding it is no longer an option.

- Real capital shifts: Moving beyond minor adjustments to fundamentally reallocating capital from high-carbon to low-carbon solutions. This is paramount because the investment decisions made today determine the world’s economic production function for decades to come. Every dollar allocated to fossil fuel infrastructure locks in emissions for the 30-50 year lifetime of those assets, while investments in clean technology accelerate their development and deployment, reshaping the economy’s foundation

- Policy advocacy: Supporting the regulatory frameworks needed to accelerate the transition, rather than obstructing them

- Innovation focus: Directing capital toward technological breakthroughs that can accelerate decarbonization, dematerialization, and massively increase productivity

Conclusion: Choose Which Side of History

The financial industry stands at a crossroads. We can continue the cognitive dissonance of projecting climate catastrophe while financing its causes, or we can embrace our true purpose as stewards of capital and architects of prosperity.

The current path is financially unsound. When major banks project a 3°C world while continuing to finance fossil fuel expansion, they’re exposing themselves and their clients to incalculable risks while missing historic opportunities.

The choice is clear: we can be remembered as the industry that knowingly financed climate catastrophe, or as the visionaries who helped build a sustainable, prosperous future. The former path leads to irrelevance and liability; the latter to growth, safety, and enduring value.

The time for half-measures and contradictions has passed. The asset management industry must embrace an authentic climate strategy because it’s the only financially prudent path forward in a world that cannot afford—literally and figuratively—a 3°C future.

###

Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” “Investing for the Next Economy,” “Next Economy Portfolio Theory,” and “Next Economics.” Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Nothing in this post should be construed to be individual investment, tax, or other personalized financial advice. Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/