Deprecated: Creation of dynamic property SocialSharing_Shares_Controller::$models is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/vendor/Rsc/Mvc/Controller.php on line 28

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$profile_name is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 86

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$sharesLists is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 121

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$useShortUrl is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 146

Deprecated: Creation of dynamic property SocialSharing_Projects_Builder_Network::$mail_to_default is deprecated in /www/greenalphaadvisors_356/public/wp-content/plugins/social-share-buttons-by-supsystic/src/SocialSharing/Projects/Builder/Network.php on line 151

By Garvin Jabusch.

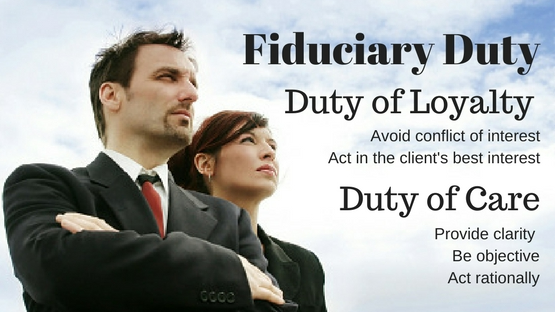

The traditional interpretation of fiduciary duty has often centered on the principle of maximizing financial returns for a given level of risk. However, the increasing recognition of climate risk, both as a systemic risk to the global economy and a specific risk to certain sectors and assets, has led to a reevaluation of what it means to fulfill this duty. I argue that there is a higher level, more important case to be made: when irreversible climate thresholds are exceeded, the degradation of the global economy will be such that investment theory and fiduciary duty will, of necessity, change to prevent massive wealth destruction. From that premise, should the prudent fiduciary not divest from fossil fuels (or as IEA suggests, at least stop financing new developments) as a means of economic risk mitigation and therefore wealth preservation?

In short, the argument I’m advancing pushes the boundaries of traditional investment theory and fiduciary duty by posing the question: What good is wealth maximization or preservation in a world where climate change has severely degraded the quality of life and the functioning of the global economy? In such a scenario, the prevailing investment frameworks might become irrelevant or significantly challenged. When we reach a point where climate change impacts are so severe that they disrupt societal and economic systems, the notions of financial return, wealth preservation, and even the concept of fiduciary duty could be fundamentally altered.

Given the potential severity of such a situation, I argue that fiduciaries should act now to mitigate these risks. Put another way, we can’t wait until the world is more severely degraded to change our inherited rules to prevent that degradation. It’ll be too late. From this perspective, divesting from fossil fuels isn’t just about financial returns or risk management in the traditional sense; it’s about preventing a scenario where the basic principles governing our economic and financial systems break down due to the severity of climate impacts. Yes, I’m arguing that risk management in the traditional sense is no longer serving our best interests. In this new world we’ve created, one of perpetual polycrisis, I believe fiduciaries have a duty to help maintain the very systems that make wealth creation and preservation possible. This, to me, is the true exercise of prudent fiduciary responsibility.

Divesting from fossil fuels is obviously a key part of this broader fiduciary duty. By moving investments away from industries that contribute to climate change and towards those that help mitigate it, fiduciaries can and should contribute to efforts to prevent worst-case climate scenarios. This would represent a form of risk mitigation and wealth preservation not just for their specific beneficiaries, but for society as a whole.

Yes, this is a radical reinterpretation of fiduciary duty, and, if proposed by a regulatory agency it would likely face significant legal and practical challenges. However, given the magnitude of the threat posed by the climate crisis, and the need for our financial and economic systems to adapt in response, it seems like a fight worth picking.

Green Alpha Advisors, LLC is an investment advisor registered with the U.S. SEC Registration as an investment advisor does not imply any certain level of skill or training. Green Alpha is a registered trademark of Green Alpha Advisors, LLC. Green Alpha Investments is a registered trade name of Green Alpha Advisors, LLC. Green Alpha also owns the trademarks to “Next Economy,” “Investing in the Next Economy,” and “Investing for the Next Economy.” Please see additional important disclosures here: https://greenalphaadvisors.com/about-us/legal-disclaimers/